| Good morning. Moderation in Fed's rate hikes, Credit Suisse's business revamp and Britons are facing the worst strikes in over a decade. Here's what people are talking about. Federal Reserve officials look set to moderate interest-rate increases again, with Chair Jerome Powell keeping further hikes on the table while leaning against bets they will cut later this year. The policy-setting Federal Open Market Committee is widely expected to raise rates by 25 basis points at the conclusion of its two-day meeting Wednesday, bringing its benchmark to a target range of 4.5% to 4.75%. The move would be another downward step for officials, who increased rates by 50 basis points in December, following four 75 basis-point hikes last year. Traders are betting artificial intelligence and machine learning will have the biggest impact on financial markets in the coming years. More than half of respondents to a JPMorgan Chase & Co. survey of 835 institutional and professional traders said those technologies would have the most influence on trading in the next three years. That's up from a quarter in 2022. Many asset managers already try to integrate some form of AI into their systems and algos, according to Bloomberg Intelligence's 2022 US Institutional Equity Trading study. Still, the majority regarded AI as more of a "catchword emerging technology."  | Credit Suisse plans to shift an asset management business that helps buyout firms raise funds to its First Boston spinout as the firm works to reshape its investment bank after losses. Internal discussions are taking place on moving the Private Funds Group, co-headed by David Klein in the US and Michael Murphy in London, to First Boston later this year, people with knowledge of the matter said, asking not to be identified. The Zurich-based lender is in the midst of working out how to carve out its investment bank into the rebranded Credit Suisse First Boston and which businesses will be housed there. Swathes of office staff will be forced to work from home Wednesday as widespread industrial action closes schools and cripples Britain's rail network. As many as 475,000 union members are on strike, demanding pay rises that do more to combat the cost-of-living crisis. Many were given salary increases of less than 5% last year, even as inflation climbed above 10%. The day of coordinated industrial action is expected to be Britain's most severe day of strikes for over a decade, piling pressure on Prime Minister Rishi Sunak's Conservative administration to resolve disputes with public sector workers by making more generous offers on pay. European shares are poised to nudge higher ahead of the Fed's rate decision. Expected data include Austria and Italy CPI inflation, plus UK Nationwide house prices. Pharmaceuticals are in the earnings limelight with GSK, Novartis and Novo Nordisk all reporting. Meta and Peloton are also on deck for results. This is what's caught our eye over the past 24 hours. - Adani stock slump worsens as key share sale fails to lift mood.

- Intel slashes CEO pay by 25% as part of companywide cuts.

- Housing slump deepens from US to China in risk to global growth.

- UK warns of ``severe'' penalties for offshore property owners.

- Nikki Haley plans to challenge Trump with 2024 White House bid.

- Perella London banker suspected in insider probe dies by suicide.

- Sean Penn's disaster-relief charity ended up a money mess.

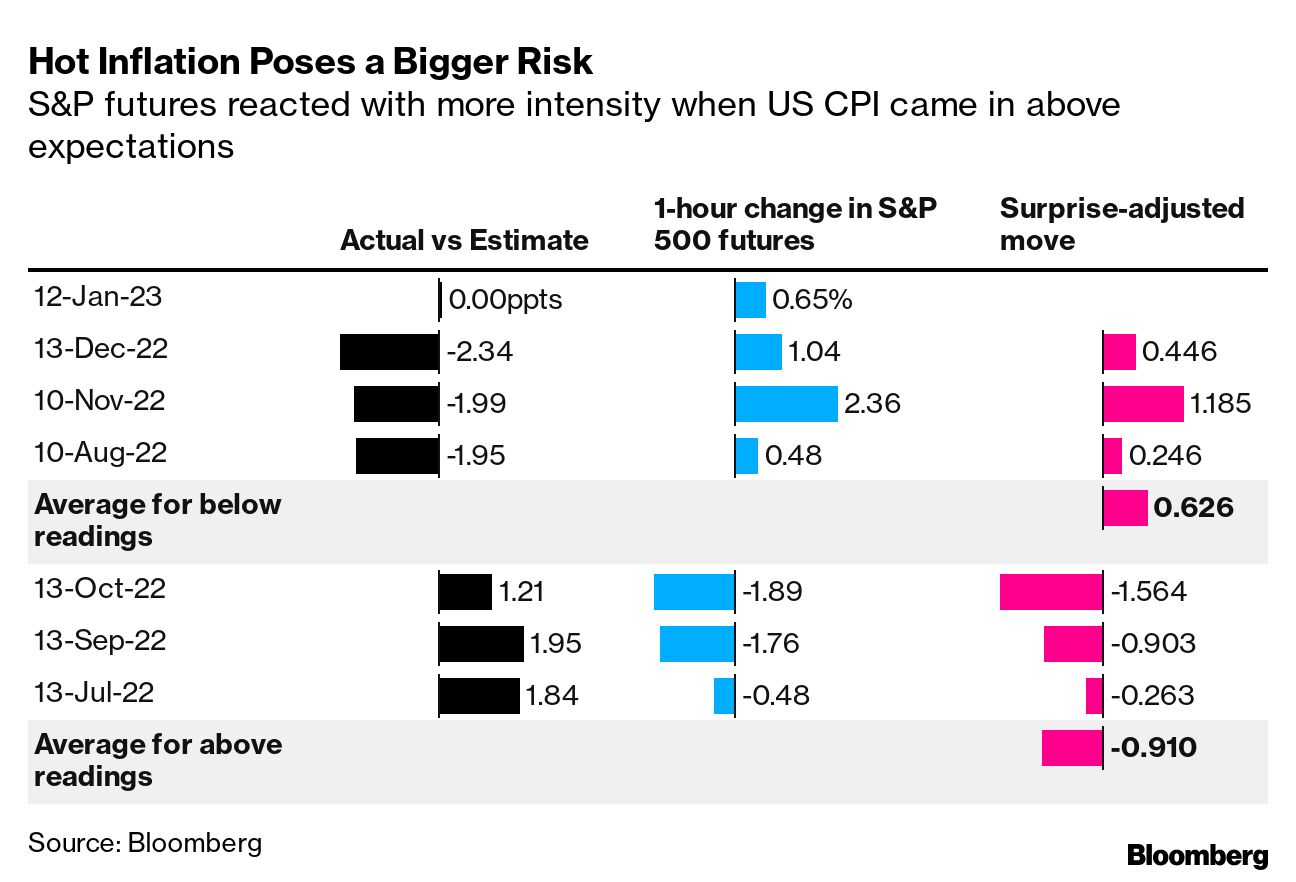

Spain certainly gave European investors something to think about ahead of Wednesday's inflation print. The upward tick to 5.8% y-o-y was a full percentage point above survey estimates. That's a mammoth beat for this normally predictable data set, perhaps aided by the fact that the eurozone inflation basket was reweighted. France came in line with expectations. Now, Spanish inflation isn't usually top-tier data, as John Authers points out. The strength of the market reaction, then, should be seen as a warning that risks of outsized moves are tilted towards above-expectations readings. This is borne out by US data. The past seven CPI readings came in above or below expectations three times each and in-line once. Yet the average move in S&P 500 futures was larger when inflation came in hot than when it came in cold, adjusted for the size of the surprise. For instance, when CPI hit 1.95 points below expectations on August 10, stock futures rallied 0.48% in the following hour. The following month, it came in exactly the same number of points above expectations, yet stocks fell 1.76%. There may be logic in this. Policymakers from the Fed to the ECB -- for all their hawkish pronouncements -- are probably looking for an excuse to soften their stance and avoid toppling their economies into recession. Central banks talk tough, but their reaction function is tilted dovish. And markets are pricing accordingly. Hot inflation, then, is the great underpriced risk. For Europe, the headline figure is seen falling from 9.2% to 8.9%, with core to tick 10 basis points lower to 5.1%. Don't be surprised, though, if an above-expectations reading elicits an outsized response. This commentary first ran on Markets Live on the Bloomberg Terminal, where Eddie van der Walt is Deputy Managing Editor based in London. Follow him on Twitter at @EdVanDerWalt. |

Transaction alert for BTC

Transaction alert for BTC