| By Ben Elgin and Mary Schlangenstein Southwest Airlines Co. is cutting jobs in its sustainable fuel operations and working to sell a renewables company, according to people familiar with the matter, an abrupt pullback after the carrier spent the past year investing in climate-focused initiatives.

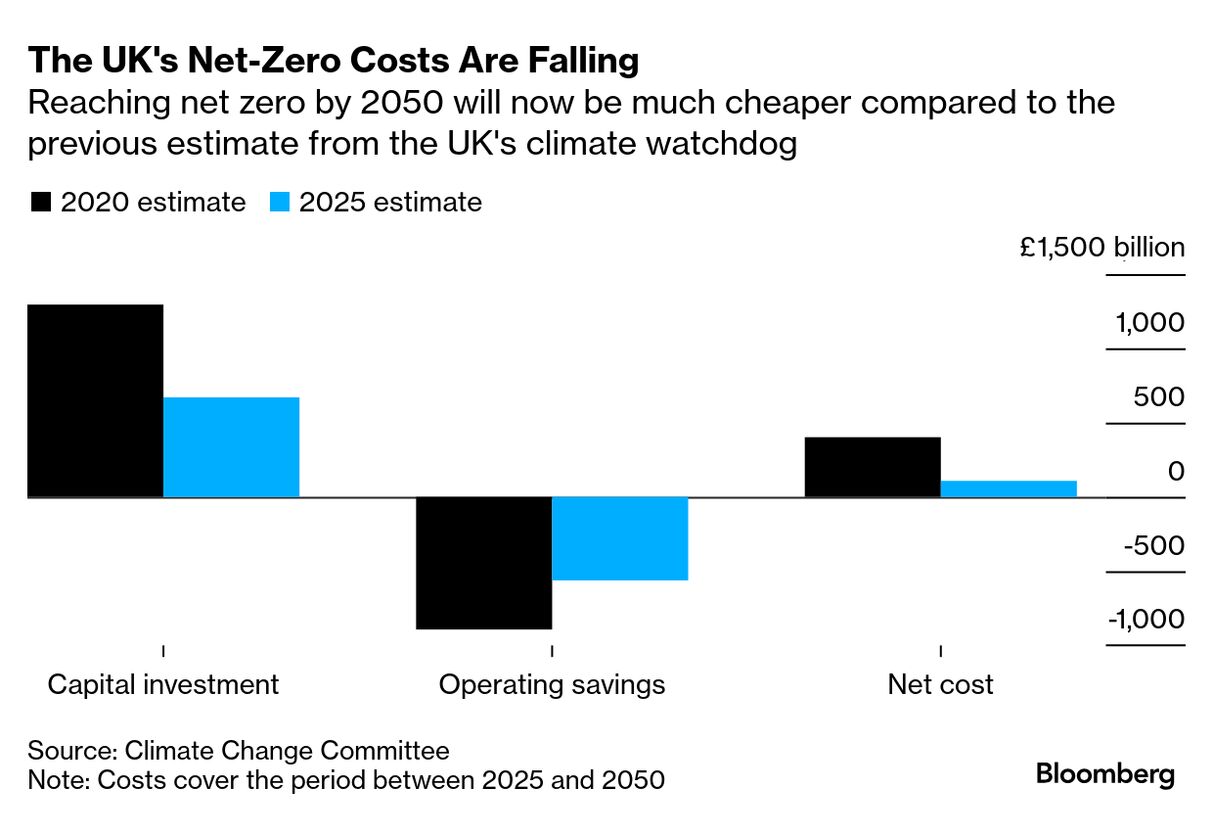

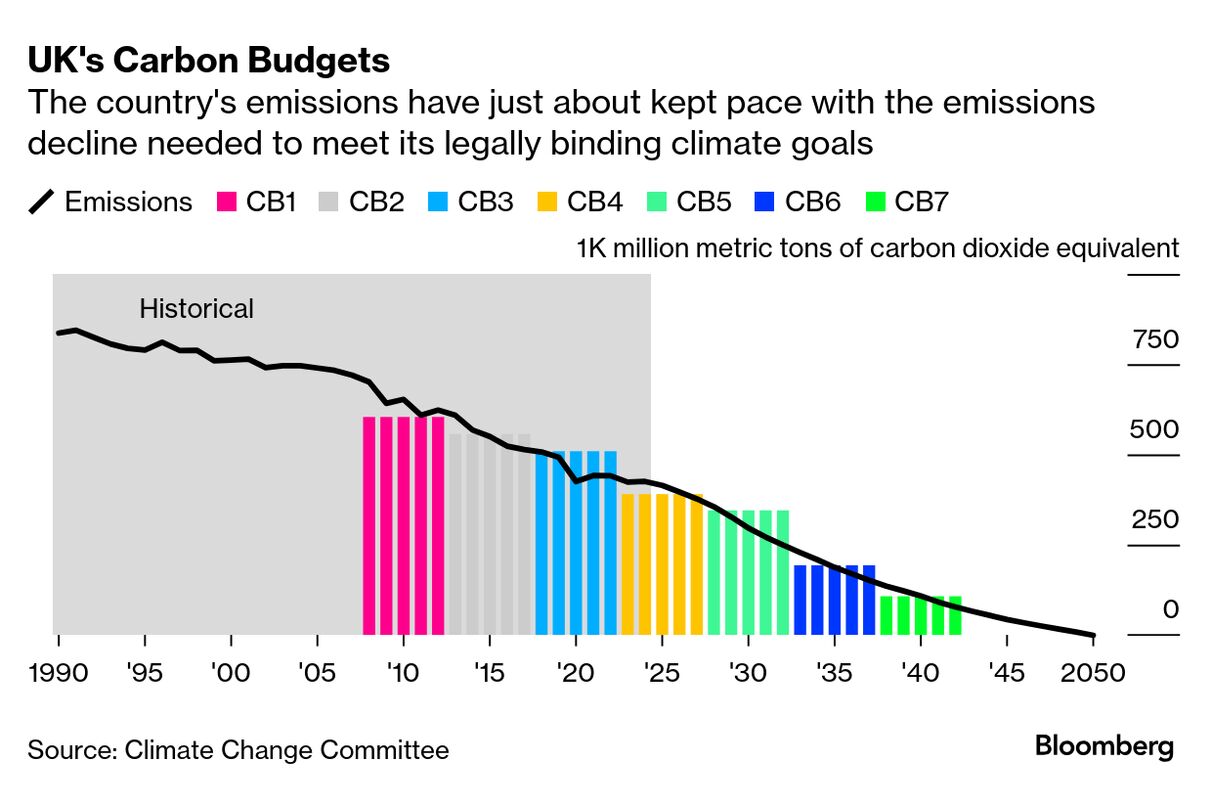

Southwest last week laid off seven out of 10 employees on two key teams that work to reduce its climate pollution and increase its use of sustainable aviation fuel, or "SAF," according to the people, who asked not to be identified discussing internal details. The airline is also eliminating a newly created team that makes investments in renewable fuel startups. That team is being given a couple of months to help unload SAFFiRE Renewables, a company that Southwest acquired just 11 months ago, the people said. SAFFiRE is seeking to develop cleaner fuels from corn husks and stalks. The cuts to Southwest's sustainability staff were part of the broader layoffs announced on Feb. 17, when the carrier slashed about 1,750 workers, or 15% of its corporate staff. It marked the first round of layoffs in the airline's 53-year history. "Many departments were affected by the layoffs last week, including the sustainability and sustainable aviation fuel teams," said a Southwest spokeswoman in a statement. Read the full story on Bloomberg.com.  The growth in cleaner jet fuel made from sources like used cooking oil and animal tallow has been slower than expected. Photographer: Angus Mordant/Bloomberg Why reaching net zero is getting cheaper in the UK | By Akshat Rathi and Olivia Rudgard These days, whether it's right-wing populists or green-minded politicians, there seems to be an agreement that the costs of meeting climate goals are higher than governments can afford. But hope might come from a little-celebrated bureaucratic organization: the UK's Climate Change Committee. In a report published on Wednesday, it said the UK can reach net-zero emissions by 2050 while spending as little as 0.2% of the country's gross domestic product or about £4.3 billion ($5.4 billion) each year on average. That's a 75% reduction from the committee's previous estimate in 2020 of net costs of £16.1 billion each year between 2025 and 2050. What happened? "Technology has continued to innovate between the last time we issued advice to the government and today," said Emma Pinchbeck, CCC's chief executive. The biggest reductions in cost come in the form of cheaper renewables and electric cars. The committee was counting on the costs of solar, wind and batteries to fall even when it gave its advice on the carbon budget in 2020, but the new estimate confirms that these technologies have fallen in cost faster than the committee was projecting. This view is backed up by others tracking clean energy markets. Since 2010, researcher BloombergNEF finds the price of solar and batteries has fallen by more than 90%, whereas wind turbines have become 59% cheaper. The CCC sees the country needing to invest £26 billion per year between 2025 and 2025 mostly toward the electrification of the economy, and as a result saving about £22 billion in operating costs. The committee's plan for decarbonization is one that can apply to other mature industrial economies, but a pathway to net zero would look quite different for a developing country with rapidly rising energy demand. To be sure, not all costs are falling. The investments needed to decarbonize buildings are higher in the CCC's 2025 estimate as the committee tempers its expectations of how quickly the UK will roll out heat pumps and insulation measures for an ageing building stock. Pinchbeck also warns that, while the overall costs have declined, it's still true that the country will have to invest a lot more over the next five years, before it starts to reap the rewards of cheaper energy costs. That may lead to an increase in energy prices in the intervening years, as the country makes upfront investments for deploying renewables and building transmission. But those costly efforts to revamp the energy system and modernize buildings will also create jobs. The UK's net-zero sector, which includes businesses involved in reducing emissions such as heat-pump makers and renewables companies as well as their supply chains, grew 10.1% in 2024, according to a report released this week from the the Energy & Climate Intelligence Unit. The think tank sees the net-zero economy starting to make bigger contributions to the UK, with an estimated 951,000 jobs that are paid £5,600 higher each year than the current national average for full-time jobs. The CCC is setting the UK's 2040 climate target to be 87% reduction in greenhouse-gas emissions, relative to 1990 levels. That's among the most ambitious goals set by a large economy. It's counter to the expectation taking hold in many of the wealthiest economies that it's economically sensible to step back on climate policies. "Regardless of what you think about climate change, when you look through the analysis you'll see a pretty good economic message for the economy and certainly a message about stability in a world of less certain geopolitics," said Pinchbeck. |

No comments:

Post a Comment