Dollar Me This, Dollar Me That | All the questions arising from the hectic first month of the second Trump administration find their expression in the dollar. So far, Trump 2.0 has been very different, and far more dramatic, than Trump 1.0, but the US currency is treating it so far as a direct replay. This is how the broad DXY dollar index performed from a month before the 2016 and 2024 elections. They've been identical, and if that carries on, there's a lot more dollar weakness ahead: Many factors drive the dollar. In 2017, it kept weakening until the administration delivered a big tax cut late in the year, then tariffs in 2018 sent it higher. But this time, its future seems to be bifurcated around two contrasting and plausible views of how Trump's financial policies will develop from here. Both find ample support in things the president and his advisers have said:

1) Mar-a-Lago Accord = Weaker Dollar The key point for dollar bears is that Trump wants a weaker dollar, and has some means to achieve this. Foreign exchange is reciprocal, and in practice it's difficult to weaken a currency without cooperation. There's a precedent in the 1985 Plaza Accord, in which officials from the then-much-smaller capitalist world agreed to intervene to weaken the dollar. The years of Reagan prosperity resulted — but Japan's experience once it had agreed to make its currency less competitive might make other countries, like China, unwilling to do the same. Scott Bessent, Trump's Treasury secretary, has made clear that he hopes to achieve some such deal. Rather than New York's Plaza Hotel, the idea is that a new accord would be struck at Trump's Florida estate, which is why the whole notion is now known as the Mar-a-Lago Accord. The idea is that other nations would agree to direct investment in the US to head off a trade war, and also coordinate to make their currencies stronger, and thus make the dollar more competitive. For the arguments as to why you should take this seriously, first read "A User's Guide to Restructuring the Global Trading System" written by Stephen Miran, the hedge fund manager and former Treasury economist who is set to become the chair of Trump's Council of Economic Advisors. It's a startlingly ambitious and wide-ranging document that has spread far and wide electronically since publication in November. It argues that tariffs provide revenue and "if offset by currency adjustments, present minimal inflationary or otherwise adverse side effects." The nub is to get others to agree to the changes. As Trump has shown in the last few weeks, there are plenty of other sticks in his arsenal beyond tariffs to persuade others.  Tools of persuasion. Photographer: Al Drago/Bloomberg For arguments promoting it, try this Odds Lot podcast with Jim Bianco. In Bessent, the US has someone with the intellectual nous to structure a deal, and in Trump an unpredictable figure who successfully inspires fear in his interlocutors — a potent combination. For the arguments against, I recommend this podcast from TSLombard, in which the economists Dario Perkins and Freya Beamish lay into the concept. Perkins points out that central banks and governments don't believe in intervening in currency markets anymore, and the only government that could change its currency is China's. The yuan is tightly managed, but Beijing's "problem is that their domestic economy is broken and their currency wants to go down, not up." Another element is that foreign governments could help the US fund itself, and avoid any downward pressure on the dollar, by swapping their current holdings of US bonds for zero-coupon non-marketable century bonds. In other words, the US would get financing locked up for 100 years without having to pay interest in the interim, and foreign creditors wouldn't be able to trade it. Set out like this, it's easy to see why Perkins calls the idea "mad" and devoid of logic. It's also hard to see how this could be achieved without a Godfather-level amount of coercion. But the arguments are there, the US is in a powerful position, and it's obviously what the administration wants. 2) Trade War = Strong Dollar The key issue that dogs the weak dollar call is tariffs. All else equal, when a nation levies tariffs it strengthens its currency. But despite the noise, the only concrete action until now has been an extra 10% tariff on imports from China (way below the 60% Trump proposed during the campaign).  At the Port of Los Angeles, nary a tariff in sight. Photographer: Kyle Grillot/Bloomberg So far, the measures lack the decisiveness that Trump once promised and cast doubt on his claim to the crown of William McKinley, the protectionist 25th president and Tariff King. To quote Jonas Goltermann, markets economist at Capital Economics: On trade policy (along with fiscal, the key policy area for currency markets) there arguably has been more sound and fury than substance. Market participants appear to have interpreted the administration's approach as more open to negotiations around trade than might have been expected based on Trump's campaign rhetoric.

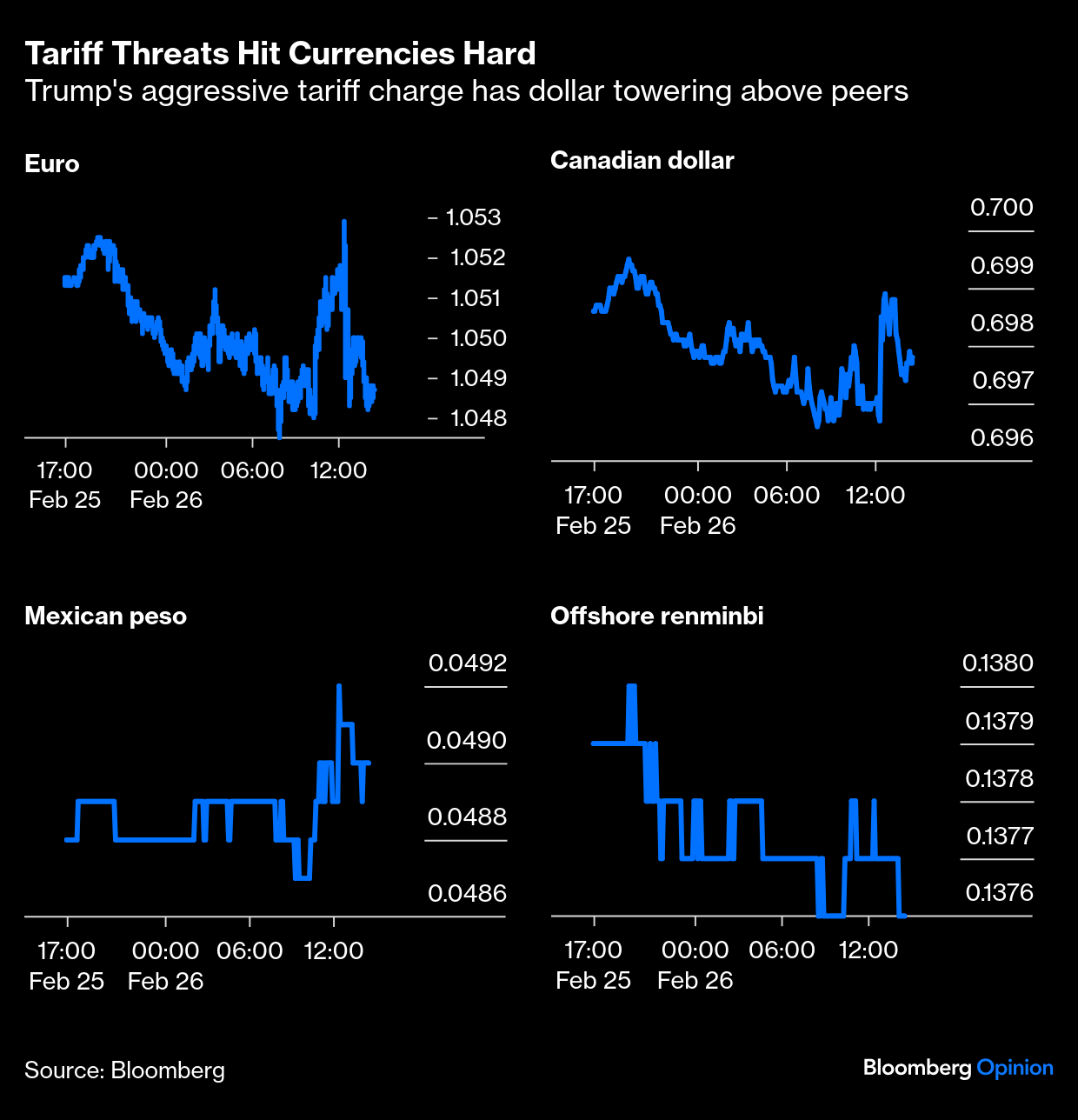

Is it safe to assume that more tariffs aren't coming? The president's threats against Canada and Mexico over non-trade issues reinforced the belief that he was using levies as a negotiating tool. His remarks on Wednesday suggesting 25% duties on European automobiles and his plans to proceed with levies on Mexico and Canada in April (when he had previously talked of a March deadline) provided little clarification. They're consistent either with using tariffs to raise revenue (and make it easier to cut taxes), or with another round of bruising negotiations designed to win concessions. As Trump badly wants lower rates and a weak dollar, he might well duck major new tariffs. Logically, a trade-off is a realistic expectation, especially with the fine details of the reindustrialization plan still lacking. But it would be dangerous to assume this administration isn't serious about tariffs. This is how the currencies currently caught in the US crosshairs reacted to the president's comments at the cabinet meeting. All weakened, but not by that much: Calvin Tse, head of Americas macro strategy at BNP Paribas, expects "very large" tariffs by the year's close, pointing to Bessent's recent remarks. Tse explains that foreign exchange is just a mechanism that balances competitive forces around the world: As the US increases the average tariff on the rest of the world, that makes the US more competitive. Moreover, we expect the Fed to remain on hold for the rest of this year, which should mean that interest rate differentials continue in favor of the US dollar.

A strong dollar would dent EU economic growth, worsening a potentially significant deterioration in transatlantic relations. Bloomberg Economics' Jamie Rush and Maeva Cousin argue that in the worst-case scenario, a blanket 25% tariff could hit European gross domestic product by as much as 1.5%: The experience of Canada and Mexico has been that political concessions can at least buy time. What sets the EU apart is that Trump's grievances run deep and are multi-dimensional — in fact, he said on Wednesday the bloc was "formed in order to screw the United States." Goods trade imbalances, digital services taxes, low defense spending and higher sales taxes are all on the list and the EU will not be able to address anything like all of these.

Turning the screw. Photographer: Geert Vanden Wijngaert/Bloomberg A point of hope for those who expect a weaker dollar is Trump's pivot from blanket tariffs to reciprocal tax measures, but Gavekal Research's Udith Sikand argues that this is "easier said than done." Based on the details available, he said it was unlikely to achieve fairness and reciprocity: If the administration does attempt to implement Trump's promise, the results are likely to be an administrative debacle, along with retaliatory escalation that could fatally undermine the foundations of the global trading system. For these reasons, the US is almost certain not to proceed with Trump's plan in full. However, selective actions against high-profile targets could still prove deeply destabilizing.

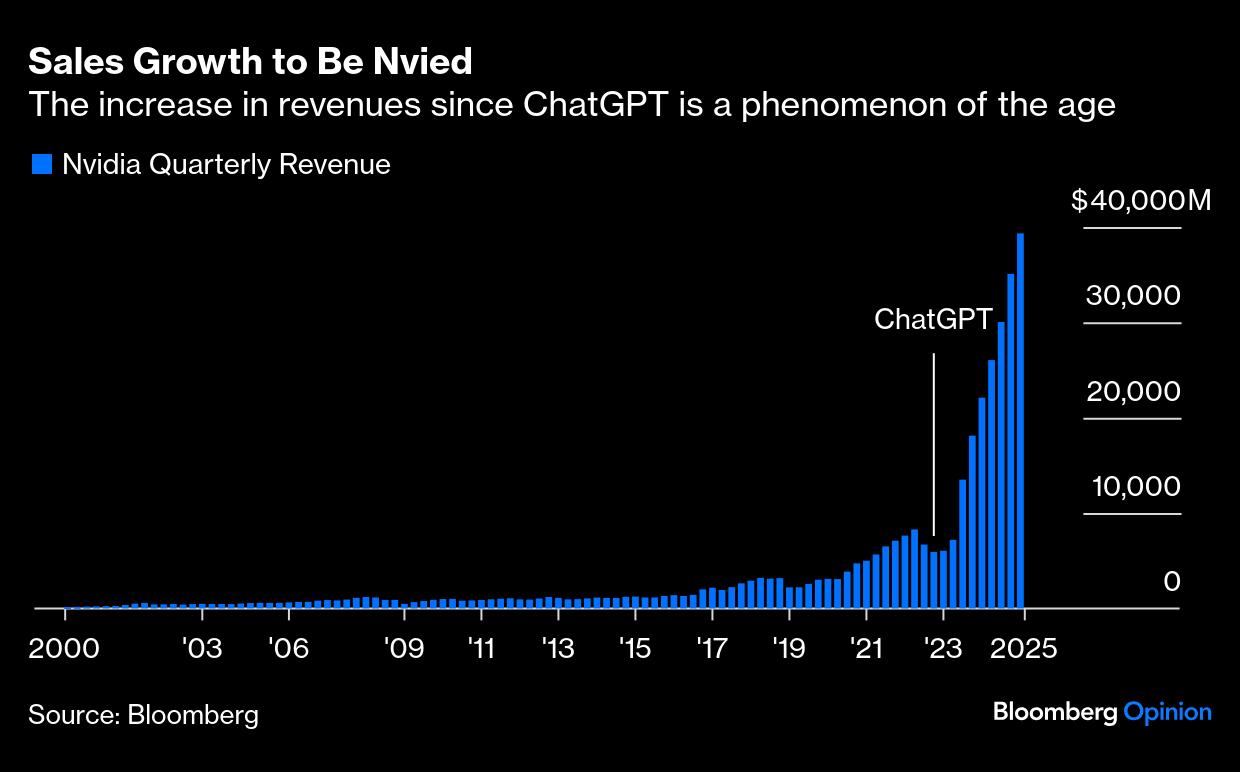

Should the US proceed with an expansive reciprocal approach, it would have to comb through a complex maze of thousands of product categories for multiple countries to apply appropriate tariff rates. Thus, Sikand suggests a focus on major trade partners is more likely. Countries may be willing to cut a deal to escape, perhaps through agreements to buy more US liquefied natural gas or take on more defense purchases. That would still strengthen the dollar. —Richard Abbey and John Authers Nvidia Corp., the dominant maker of the chips needed for artificial intelligence, has reported results for the quarter ending in January. In a remarkable achievement, they managed to produce a non-event. Since the launch of ChatGPT set off an AI arms race that ignited demand for its products, Nvidia's quarterly numbers have typically been followed by double-figure moves in its share price after hours. This time, it moved around a bit, but ultimately ended up more or less where it started: This might seem odd. Profits came in ahead of market expectations, as did revenues. As it's still only a month since the Chinese DeepSeek AI app sparked fear that Nvidia's business model wasn't as impregnable as had been assumed, this might have been expected to deliver quite a surge. At $131.28, the stock is still 8% lower than $142.65 before the DeepSeek shock. Growth in revenues continues to be astonishing. There are arguments about whether the company is overvalued, but its sales leave no doubt that something remarkable is happening: The problem was that Nvidia's profit margin was trimmed a little as it spent heavily to launch its new Blackwell range of chips. It's never great when a company sees its margins trimmed, but this needs to be seen in context. Below is Nvidia's operating margin each quarter going back to 2000: This remains a stunningly profitable company, whose margins have multiplied several times since ChatGPT. If any shareholders really wanted it to keep pushing up margins, they might look a little greedy. It's always risky to extrapolate much from the immediate response to an earnings announcement in thin trading. If the market's judgment stands up Thursday, it can perhaps be taken as a sign that Nvidia is indeed priced for perfection. Because these numbers were not that far from perfection. A propos of nothing in particular, I found this fascinating essay on early adventures in color photography thanks to The Browser. The images that people made over a hundred years ago with the aid of glass-plate negatives covered in grains of potato starch dyed in the three primary colors are quite breathtaking. Changing technologies can change the way we view the world, and occasionally create beauty. It's been happening for a long time.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Jonathan Levin: The Mastermind of Tariffs Already Gave Us a Preview

- Lionel Laurent: Even Germany Is Gaullist Now. Well Done, Trump

- Linda Jarvis: Measles Outbreak Was Entirely Avoidable

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment