| I'm Augusta Saraiva, a US economy reporter in New York. Today, we're looking at US inflation. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President Donald Trump is confusing investors with apparently contradictory answers about his plans to enact tariffs on the likes of Canada and Mexico.

- The number of births in Japan fell to another record low, deepening the demographic crisis.

- Trump has shocked Europe into chasing billions in additional financing for defense.

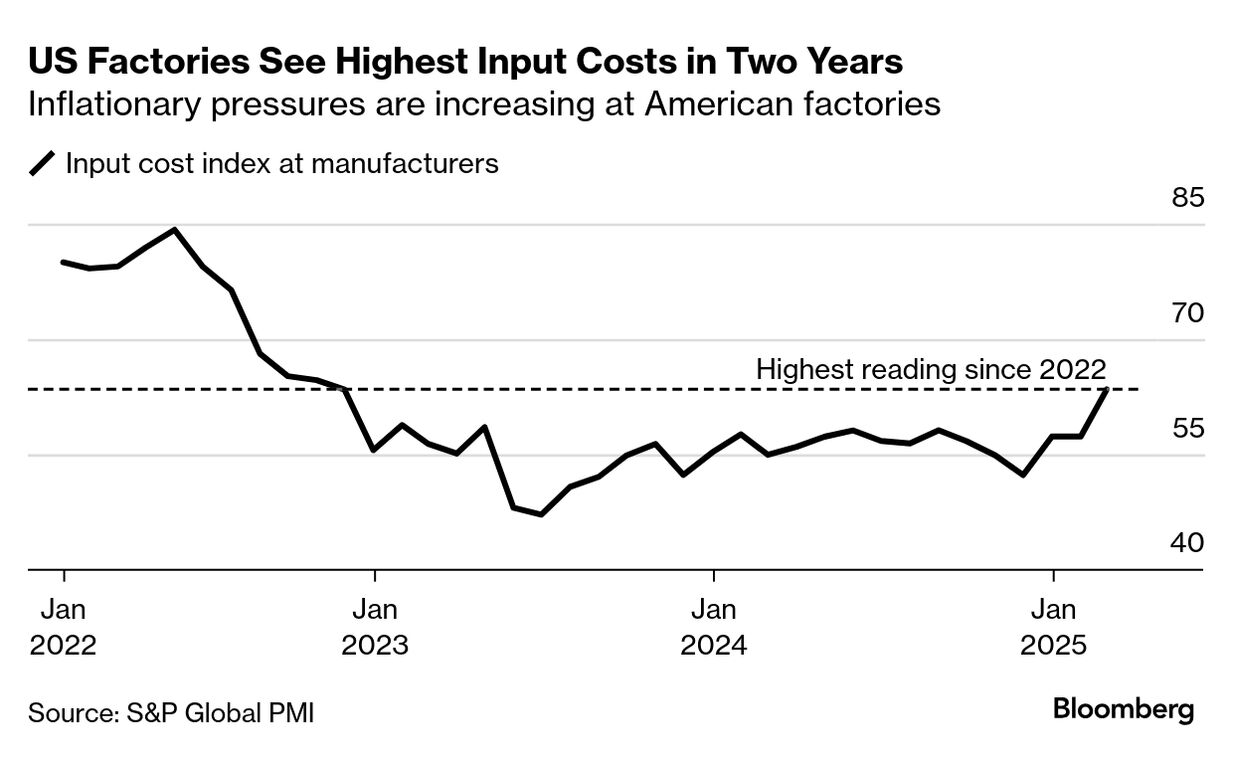

After progress on inflation stalled in the US last year, there are now signs everywhere that it may be reversing. Consumer and producer indexes picked up by more than expected in January, the costs of some raw materials are surging and even some metrics of wage growth are accelerating. The underlying factors are multiple — including the bird flu driving up the price of eggs. But the overall takeaway is that inflation seems to be making a comeback. Americans took notice and are growing increasingly pessimistic on the outlook for prices. Long-term views of inflation surged to the highest in nearly three decades in the most recent report from the University of Michigan. Other surveys have also pointed to higher expectations. Some businesses said they are already responding to tariffs, including shoe retailer Steven Madden, which plans to raise some prices in the fall. Others, including Stanley Black & Decker and Kontoor Brands — maker of the Lee and Wrangler jeans — are mulling doing the same. All these factors are supporting the Federal Reserve's wait-and-see approach to rate cuts. Central bankers have pointed to sticky inflation figures, as well as a still-robust labor market and uncertainty around Trump's economic policies, as cause for patience. "I recognize the fight against inflation has been long, but it is critical that we remain steadfast," Richmond Fed President Tom Barkin said Tuesday. The Fed's preferred inflation metric, due Friday, will likely do little to assuage concerns. Economists estimate the core personal consumption expenditures index — which excludes the volatile food and energy categories — accelerated in January from the month before. The Best of Bloomberg Economics | - Trump's plans to reform global trade have sparked speculation about a potential "Mar-a-Lago Accord" to deliberately weaken the US dollar. Investors are parsing the words and writings of Stephen Miran, Trump's pick to head the White House Council of Economic Advisers, for clues on such policies.

- Britain will be hit by rising prices and severe bottlenecks as a result of the Labour government's plans for an historic increase in building projects, analysis shows.

- Hong Kong is bracing for growth risks with 10,000 civil servant job cuts.

- Indian officials are exploring ways to lower tariffs on a wide range of imports in a bid to evade Trump's threatened reciprocal levies.

- Grocery stores are promoting homegrown produce to consumers as 85% of Canadians hunt for alternatives to US goods.

- Central bankers are turning to social media to reach young constituents.

The 10% tariff surtax on all Chinese imports that Trump imposed just over three weeks ago may have a bigger impact on the US economy than official trade data would suggest, according to analysis by economists at the New York Fed. US data indicate that the country imported $439 billion of Chinese goods last year, but China's figures tell a different story, the New York Fed's Hunter Clark wrote in a blog post Wednesday. Beijing's numbers show some $524 billion worth of exports to the US.  The Yangshan Deepwater Port in Shanghai, China, on Monday, Feb. 10, 2025. Bloomberg "Simply stated, the US is saying it buys from China a lot less than what China says it is selling," Clark wrote. Thus, the impact of the new tariffs could be bigger than expected. Also — assuming Trump follows through on plans to tariff "de minimis," or small-value imports — Clark said that move means "consumers could face larger consequences than meet the eye," especially if Chinese sellers don't slash their profit margins. |

No comments:

Post a Comment