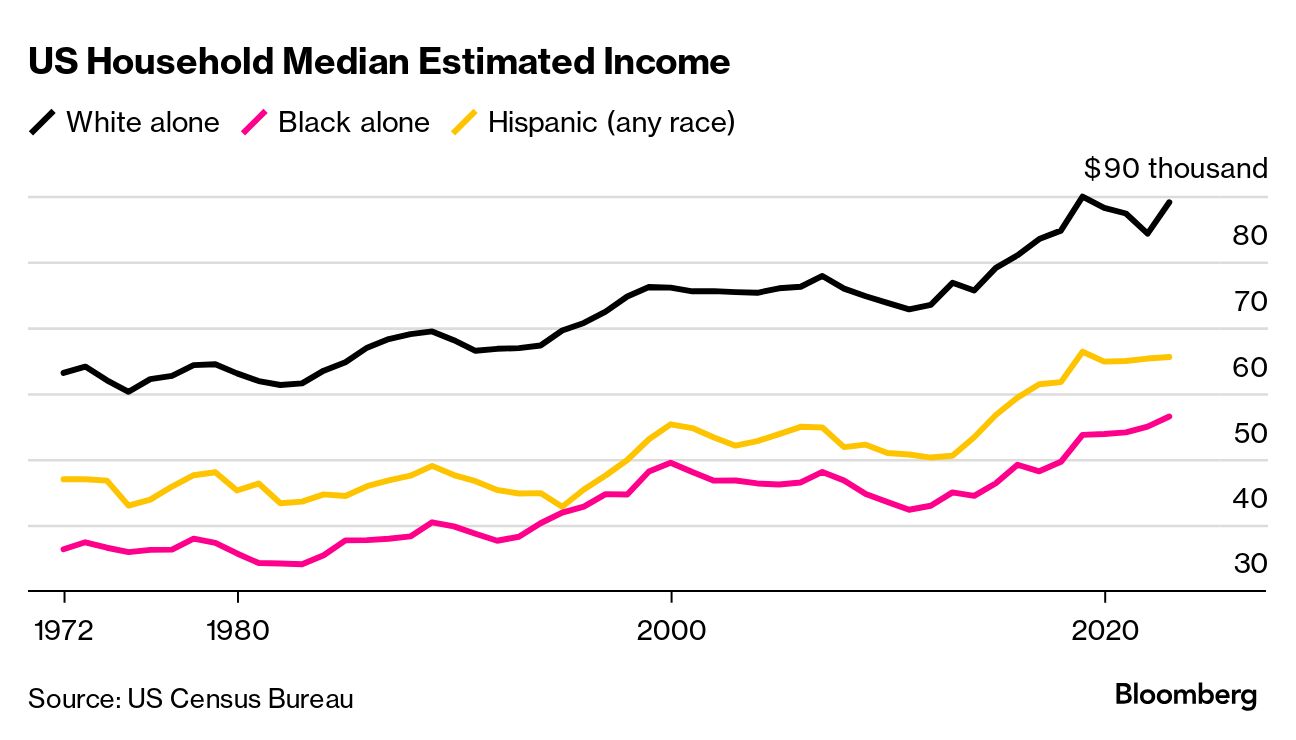

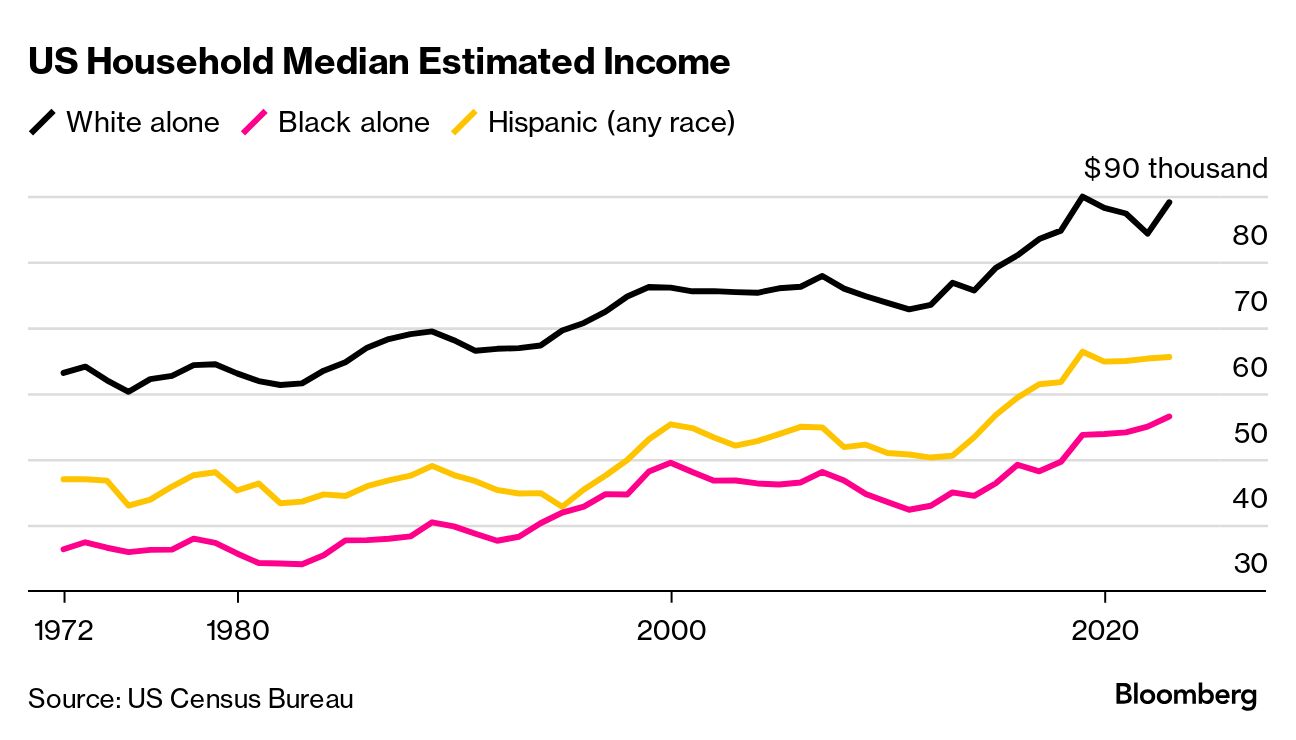

| Earlier this month the US Census Bureau released its 2023 data on household income and at first glance the news looked pretty good: median household income had risen 4% between 2022 and 2023 and now stood at just over $80,000. This was the first statistically significant rise in household income since 2019, yet another sign that the post-Covid economy was continuing to improve.

Then I noticed something: this rise in household income was mostly concentrated among White Americans. Household income for Asian, Latino and Black Americans held steady.

In fact, the median income for Black households ($56,490) was just 63% of that of White ones ($89,050). That was only slightly better, percentage-wise, than 2019, the last year incomes rose significantly. In fact, Black households were making about the same as households headed by people without college degrees, even though more than a quarter of Black Americans have a bachelor's degree or higher. This is just the racial income gap, of course. The racial wealth gap — the difference in per capita wealth between Black and White Americans — is even larger. A different Census report from earlier this year found that while Black families account for 13.6% of all US households, they hold only 4.7% of US wealth (which counts the value of assets like property and investments). By comparison, nearly two-thirds of US households are White, but they account for 80% of the wealth. In fact, according to a 2022 study by researchers at Princeton University and the University of Bonn (in Germany), which looked at racial wealth disparity in the US from 1860 to 2020, the racial wealth gap has actually started to widen in recent decades. In other words, racial wealth inequality is getting worse, not better.

That's not to say there hasn't been progress. In the first 50 years after slavery was abolished, the ratio of White-to-Black per capita wealth fell dramatically, from a ratio of about 60:1 to 10:1. By 1950 it had fallen further, to 7:1. This is pretty astounding considering the myriad laws and policies — Jim Crow, redlining — that intentionally disenfranchised Black people. But 70 years later, in 2020, the racial wealth gap has only narrowed slightly, to 6:1.  Some of this stagnation is simply due to the mechanics of wealth creation. Even in a perfect world, under what the Princeton and Bonn researchers called "equal conditions for wealth accumulation," White Americans would still have three times as much wealth, per capita, as Black Americans, simply because wealth can be passed down through generations and they started with an outrageous head start. In order to make things truly equal, Black Americans would have needed some kind of economic advantage rather than just a level playing field. But those "equal conditions" have never existed in the real world, which is why the racial wealth gap is still so wide. To see what's going on, we have to take a closer look at the 70-year period between 1950 and 2020. On the whole, it looks like a period of stagnation — taking a 7:1 wealth gap down to 6:1 isn't much progress — but it's actually a period of great improvement, with the dismantling of Jim Crow in the 1960s, followed by a backslide. In the 1980s, researchers say, the racial wealth gap actually started to widen.

To understand the mechanics of that backslide, it helps to look at how differently Black and White Americans invest their money. Black households hold nearly two-thirds of their wealth in the form of housing, and while real estate prices have risen substantially in recent decades, the stock market has risen even more. Some 35% of White wealth is held in stocks and bonds compared with just 8% of Black wealth, according to a Pew Research Center report from March citing data from the Federal Reserve Bank of New York. That's where the real money is made.

The US tax code advantages people who invest in the financial markets—which, as we've just discovered, skew disproportionately White. According to a 2023 study by the US Treasury, White families account for nearly two-thirds of US families but receive 92% of the tax expenditures for capital gains and dividends, 91% of the deductions for charitable donations, and 84% of the financial benefits of being able to deduct your mortgage.

None of this seems likely to change any time soon, which is why the Princeton and Bonn researchers warned that the US is at risk of undoing some of the hard earned racial economic progress it has already made. Even something as bold as a large scale national reparations program would have a limited effect, they say, unless Black Americans started participating in financial markets in larger numbers, or if capital gains were taxed at the same rate as earned income. "Should existing differences in wealth-accumulating conditions persist," the researchers warned, "racial wealth convergence will not only stop altogether, but will even reverse course."

The implications of this are huge. After all, how much money a family has determines where and in what kind of house they can afford, which in turn often dictates where their kids attend school. Can parents pay for child care? Save for their kids' college? Retire? If the racial wealth gap really does continue to increase it's going to make achieving racial equality in other areas of life even harder. |

No comments:

Post a Comment