| Here's your daily snap analysis from Bloomberg UK's Markets Today blog: This week looks set to end with a further rally in global stocks thanks to China's efforts to stimulate its economy. Risk appetite across financial markets got another boost today from the country's latest measures, propelling Asian stocks to January highs with European index futures pointing higher across the board at the time of writing. That tends to be good news for certain elements of the UK stock market — namely, financial companies with Asian exposure, miners (just take a look at iron ore prices) and luxury retailers. But yesterday we saw the FTSE 100 underperform its European peers, as well as the domestically-focused UK midcap index, the FTSE 250. Why? Well, while it has a strong showing from miners, other heavy weights include oil exploration and production companies BP and Shell. Oil is on course for a substantial weekly decline thanks to the prospect of more supply from OPEC member Saudia Arabia and Libya. The FTSE 100 also lacks exposure to the other source of yesterday's rally in Europe coming over from the US — tech — and specifically AI momentum.

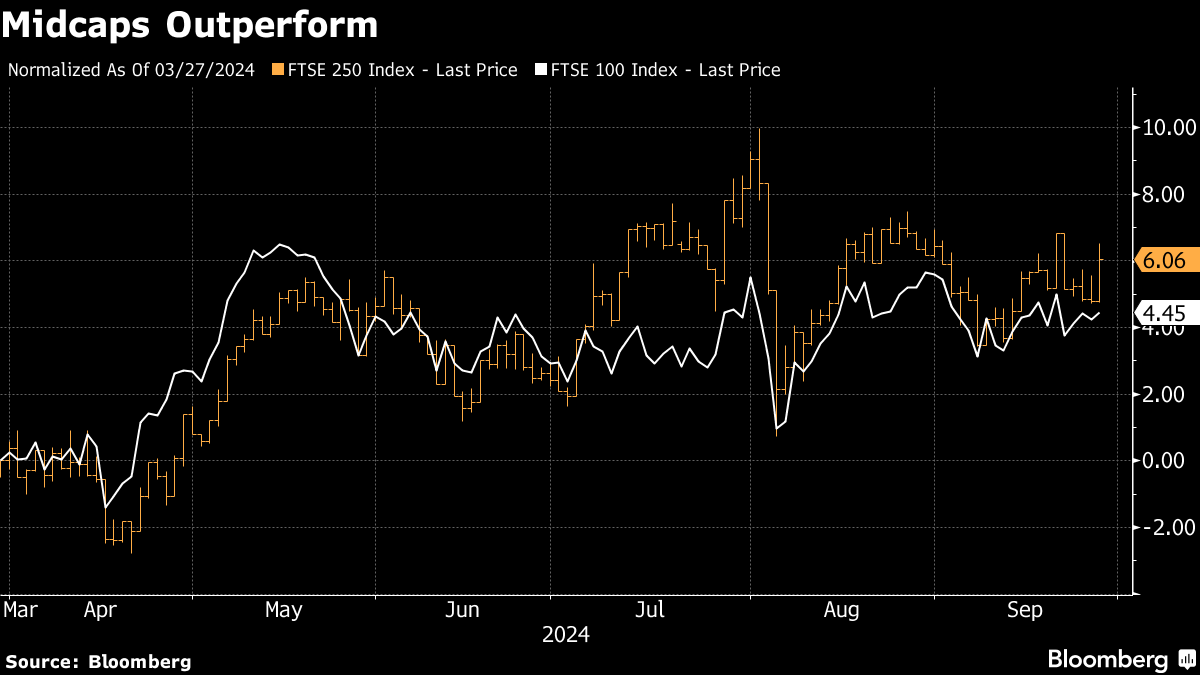

The FTSE 250 meanwhile was able to enjoy a boost from China-exposed luxury fashion house Burberry, without the oil drag. It also tends to be more sensitive to macroeconomic sentiment and the outlook for interest rates. Over the last six months the mid-cap index has returned 6.1% compared with 4.5% for the FTSE 100 and it's fared particularly well since the start of the summer as the economic outlook has picked up. — Morwenna Coniam Check Bloomberg UK's Markets Today blog for updates all day. |

No comments:

Post a Comment