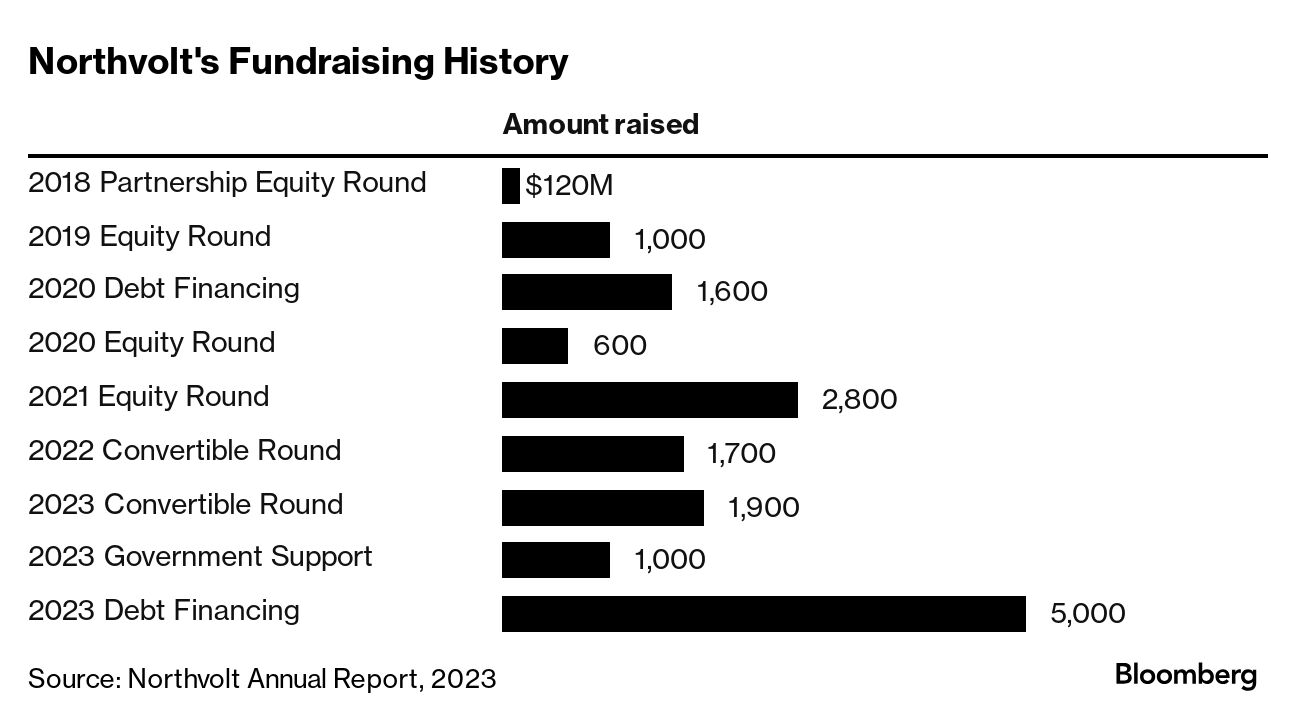

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Northvolt was supposed to power Europe's response to the likes of Tesla and China's fast-growing electric vehicle makers. Instead, the Swedish battery company is fighting to stay afloat. As it faces a crushing liquidity crunch, the company's creditors will meet Friday to decide on freeing up funds critical to its survival. On Thursday, Harald Mix, Northvolt's founder, said he plans to provide new capital to the company, pointing to the "important role" it plays in European competitiveness. Burning cash as it struggles to deliver the batteries it promised customers, Northvolt said this week it's shedding a fifth of its global staff and suspending the expansion of its main factory in northern Sweden. With Europe's EV boom turning to bust, more pain may be in the offing. "There will not be big enough demand to meet supply and Northvolt may very well be the first casualty of the market correction currently underway," said Fredrik Erixon, director at the Brussels-based European Centre for International Political Economy.  Northvolt's Skelleftea site in Sweden. Source: Northvolt AB At stake is Europe's effort to build a critical industry in a global market dominated by China's CATL and BYD, which are selling batteries and EVs at unbeatable prices. Northvolt's woes also throw into question Europe's ambitious push to build a self-reliant green economy. It's a stunning reversal for a company that less than a year ago was wooing investors for a planned initial public offering that would value the company at around $20 billion. It was the first recipient of aid the European Union has offered to keep businesses from being lured away by incentives offered via US President Joe Biden's Inflation Reduction Act, and was promising large-scale factories across Europe and North America. But like some others in the industry — Rivian, for instance — Northvolt tried to do too much too quickly, and by its own reckoning had teams that weren't always qualified to operate at scale. It struggled to provide battery cells on time to customers including BMW and truckmaker Scania. Northvolt's funding was reinforced by orders worth more than $55 billion from companies including Volkswagen and BMW. But its production woes and flagging EV demand has starved the company of much-needed revenue and led to cascading financial troubles. Salaries and social-security contributions for staff were more than three times higher than revenue from customer contracts last year. The company finds itself short of cash less than a year after securing a $5 billion green loan facility that brought its total debt and equity commitments to more than $13 billion. Northvolt has hired consulting firm Teneo for restructuring advice, including contingency planning should it fail to win revised terms from lenders. That said, the company has made significant progress in financing talks over the past couple of weeks, a spokesman said in an email, declining to provide specifics. Trouble has been brewing for some time. After shelving its IPO plans in May, Northvolt reported that its operating loss more than tripled to $1.03 billion last year on $128 million of revenue. The company also said it was pushing back ramp-up timelines at its four major sites. In August, Northvolt announced it was closing a Californian research arm. This month, the company mothballed a cathode active material production facility and terminated another, both in Sweden. "The industry is under multiple layers of pressure spanning across slower global demand, falling prices and an R&D race to next-generation technologies," said Joanna Chen, a Bloomberg Intelligence analyst in Hong Kong. "Competition is getting tougher in Europe with Chinese battery makers like CATL scaling up their local factories." Conceived by two former Tesla executives in 2016 — when money was practically free — Northvolt moved quickly in its early years. The company had three factories under development by 2019 and assembled its first lithium-ion battery cell in December 2021. Northvolt's stated aim has been to reach global capacity of 230 gigawatt-hours by 2030 across its factories, or enough batteries to power about 3.8 million vehicles. Currently, its only running site Ett, near the Swedish city of Skelleftea, has a 16 gigawatt-hours of capacity, according to BloombergNEF. In addition to that site, Northvolt said this month it remains committed to its NOVO joint venture with Volvo Car in Sweden, Northvolt Drei in Germany, and Northvolt Six in Canada. It plans to communicate timelines and potential cost savings at those locations this fall. Volkswagen said this month it remains a supporter of Northvolt's ramp-up. BMW is also keeping the door open to tapping Northvolt as a next-generation cell supplier, though this is contingent on the company showing it can produce cells to the carmaker's specifications and at scale, according to people familiar with those discussions. As Northvolt works through its woes, the Swedish government has made clear it won't be bailing out the company, and Germany says it's in constant contact with the battery maker. Some observers fear Northvolt and its supporters are fighting a losing battle. "This is a market that will undergo seismic changes in the coming 20 years, and I don't see European companies leading the charge," Erixon said. — By Kati Pohjanpalo, Charles Daly and Jonas Ekblom  A Kia Niro electric vehicle owner plugging in. Photographer: Logan Cyrus/Bloomberg Carl Ingber thought he'd have to get out and push his electric car on an August night when the battery flashed "0%" about five miles from the closest charging station in upstate New York. "It's blinking zero, limited power," Ingber, a driver with a Hudson Valley airport transport service, recounted to Bloomberg Government as he stood charging his Hyundai EV. "I'm like, 'Oh my God, am I going to make it?'" He did make it — just barely — to a federally funded fast-charging port off Interstate 87 in Kingston. It's the first EV charging station opened in New York state funded by the 2021 federal infrastructure law. Bloomberg Government encountered Ingber during an 840-mile trip between Washington, D.C., and New York to investigate the future of the federally funded EV charging network after a launch riddled with obstacles including location restrictions, state hurdles, grid reliability and private-sector charging woes. |

No comments:

Post a Comment