| • It looks like global investors really trust China's Politburo.

• The jury is still out on whether this is a true Mario Draghi Moment.

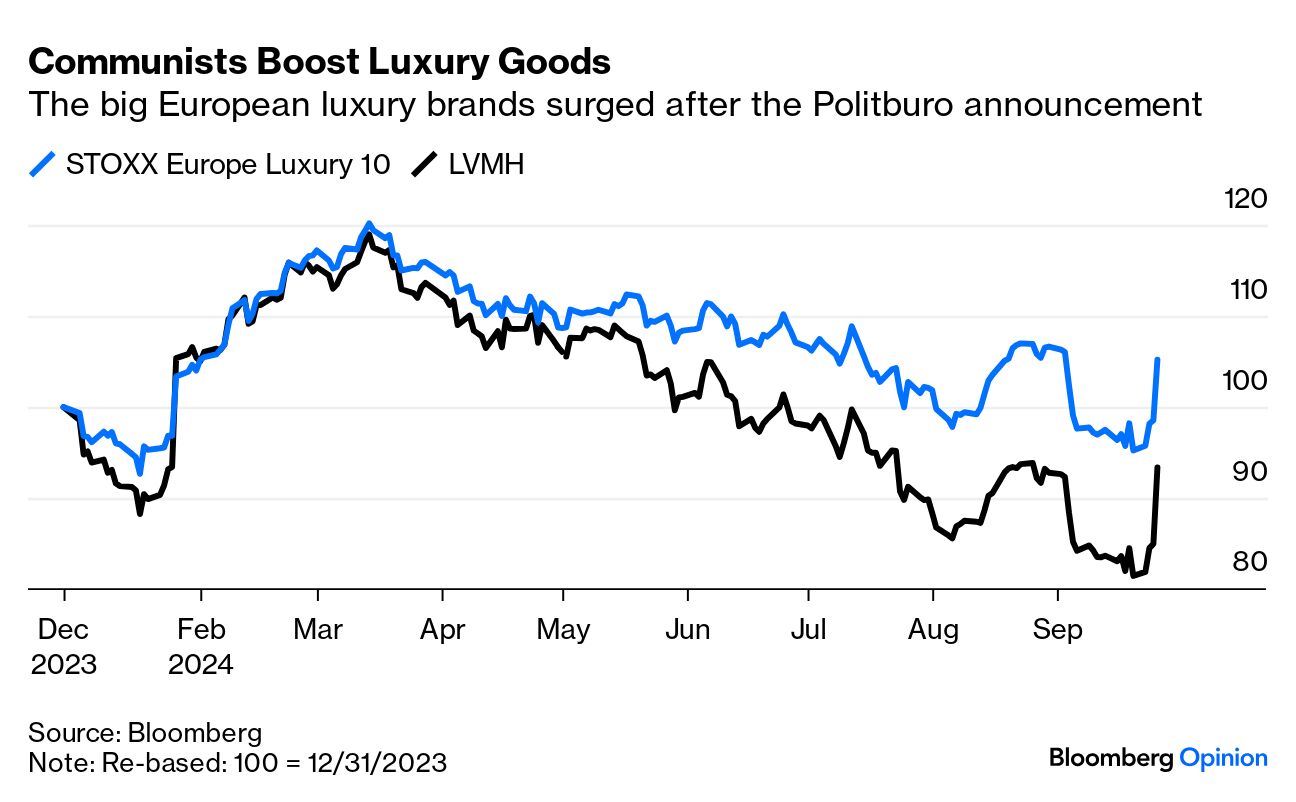

• Luxury goods are the biggest beneficiaries of communist largesse so far.

• Gold keeps setting new records, despite confidence in a soft landing.

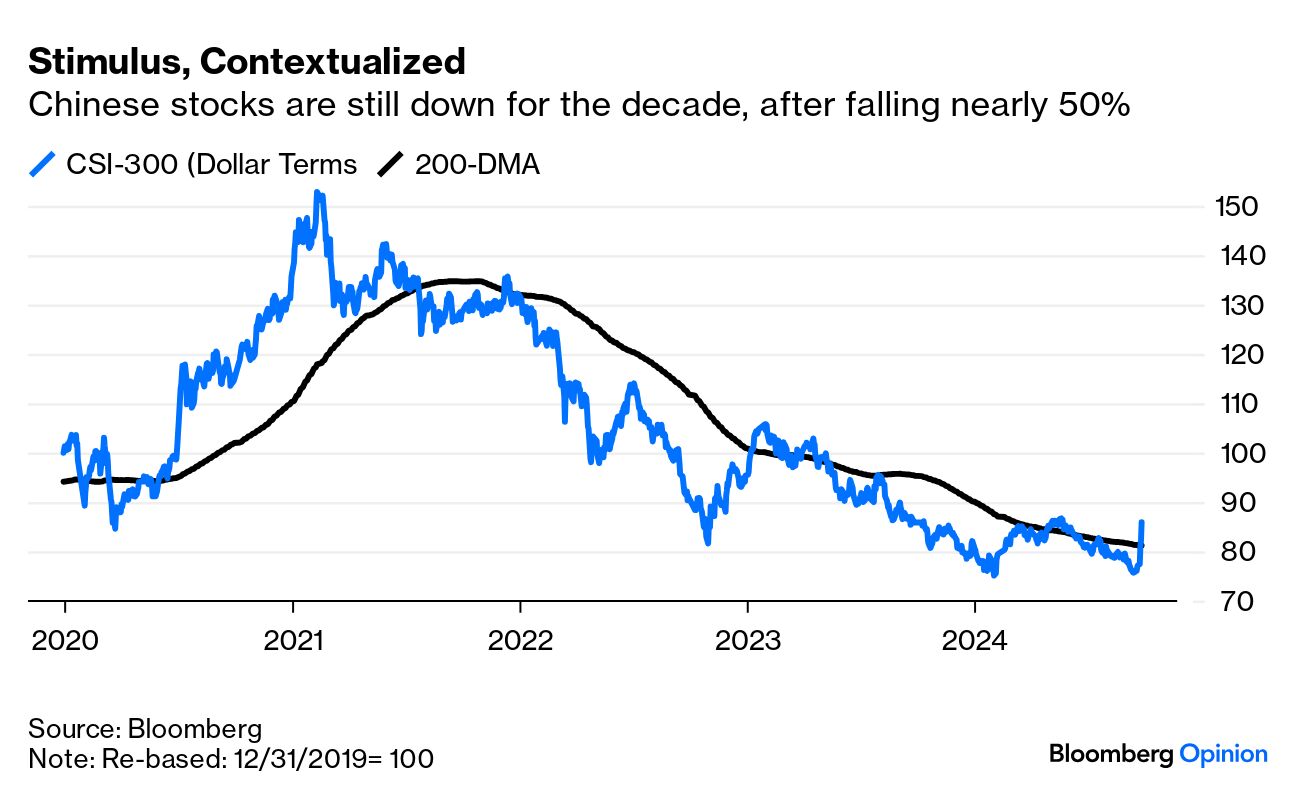

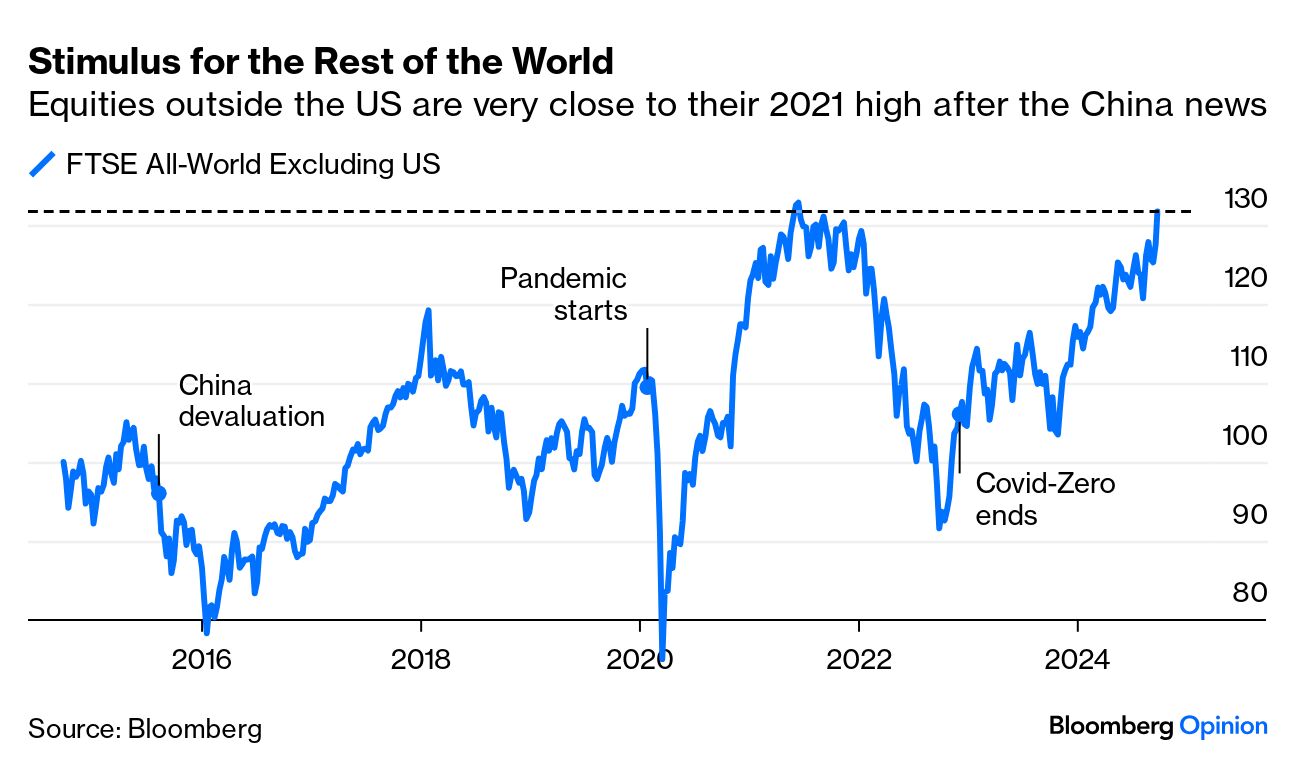

• AND: Jazz musicians like stardust even more than the rest of us. Suddenly, a lot of people are placing a lot of trust in the Communist Party of China. On Thursday, the Politburo, headed by President Xi Jinping, held an unscheduled meeting and then made an announcement that effectively amplified the monetary policy stimulus announced by the central bank earlier this week. On markets, at least, the leadership's intervention had a big impact, and it got bigger the closer you were to China. The CSI-300, an index of the biggest mainland A-shares traded in Shanghai and Shenzhen, has rallied by more than 10% this week, and it's nearly back to its high for the year:  That rally extended Friday after the central bank confirmed it was cutting the reserves that banks must hold, with the CSI-300 gaining another 2.7% in the morning session. This must of course be put in the context of a biblically awful run for Chinese equities since a brief boomlet ended early in 2021. The index fell more than 50% after that — although it's still noticeable that the CSI-300 is now further above its 200-day moving average than at any time since then, which does suggest a significant reversal: It's also had a real impact on equities beyond China's borders, helping in particular to spur excitement outside of America. FTSE's index of all world markets excluding the US has rallied within a whisker of its high from 2021: This has led to some upheavals among riskier assets. Chris Verrone of Strategas Research Partners points out that the Emerging Markets Internet ETF (known EMQQ) is now slightly ahead of QQQ, the juggernaut ETF tracking the Nasdaq 100, for the year so far. This week's leap is startling: For another very direct impact, European luxury stocks regarded as a direct play on China's newly wealthy had their best day in several years: After Tuesday's very unusual press conference by the People's Bank of China to announce a range of monetary policy developments, China-related assets had a big day, even though the immediate reaction from economists and investment analysts was that it was too little and too late to make much difference. Thursday's market action, by contrast, suggests that investors perceive the Politburo intervention to have made a real and substantive change. "By itself, the monetary policy stimulus was merely a signal that things are worse than people realize," says TS Lombard's Freya Beamish. "Today's rare surprise Politburo meeting provided few details but sent a strong signal that the fiscal authorities too are on board." So, if you hold Chinese assets, you're probably much happier than you were last week. But what exactly has the Politburo changed? There are no numbers in its statement, but there are also fewer words than usual. Several analysts pointed out that verbiage about "prudence" had been excised. It underwrote attempts to boost the stock market and put a floor under the housing market, along the lines that the PBOC had already announced. What perhaps mattered most, beyond Xi's imprimatur for those policies, was a series of declarations of intent, including (according to the Google Translate rendering of the document that can be found here) commitments to: - Safeguard the bottom line of people's livelihoods.

- Focus on employment for key groups such as fresh college graduates, migrant workers, people who have escaped poverty, and zero-employment families.

- Strengthen support for groups with employment difficulties such as the elderly and disabled.

- Strengthen assistance to low-income people; and

- Ensure the supply and price stability of important materials such as food and water, electricity, gas, and heat.

This is significant, arguably, because it shows Xi gets China's crucial need is to prod consumers to start buying stuff again, and suggests that some old-fashioned Keynesianism will be tried to boost demand. Bloomberg News' revelations that the government is considering a $142 billion cash injection for banks, and Reuters news that $284 billion in new debt will be issued, further raised confidence that the government means business.  Luxury gets a break. Photographer: Na Bian/Bloomberg This doesn't necessarily convince the skeptics that China's economy is about to turn around, but it has prompted them to buy Chinese assets. Peter Tchir of Academy Securities said that boosting the consumer was a sensible way to try to tide the economy through the long process of transitioning away from reliance on building goods for foreign companies: We had been very bullish Chinese stocks earlier this year but backed off after they ran into resistance and the Chinese economy continued to struggle. Now it is time to go back in. Again, nothing has changed about the view that China is not investible, but it is certainly tradable.

Marko Papic of BCA Research described this as Beijing's "whatever it takes" moment. This is because China has reached the point often seen in real estate and market crises where policymakers realize that austerity won't work to lift them out of the trap, and they lose their squeamishness about being seen to bail people out. "Effectively, Beijing has reached a point where the policy focus shifts from guarding against moral hazard to guarding against political risks," he said. However, Shehzad Qazi of China Beige Book suggested that comparisons to the Mario Draghi Moment, when the then-head of the European Central Bank promised to spare nothing to rescue the euro, were overdone. Beijing has no track record of effectively boosting consumer demand, nor did the Party lay out many concrete steps it plans to take here (disregarding "guidance" to localities). One can certainly hope for a wealth effect from stocks and property, but stocks will be temporary and the wealth decline from property is overwhelming compared to any relief.

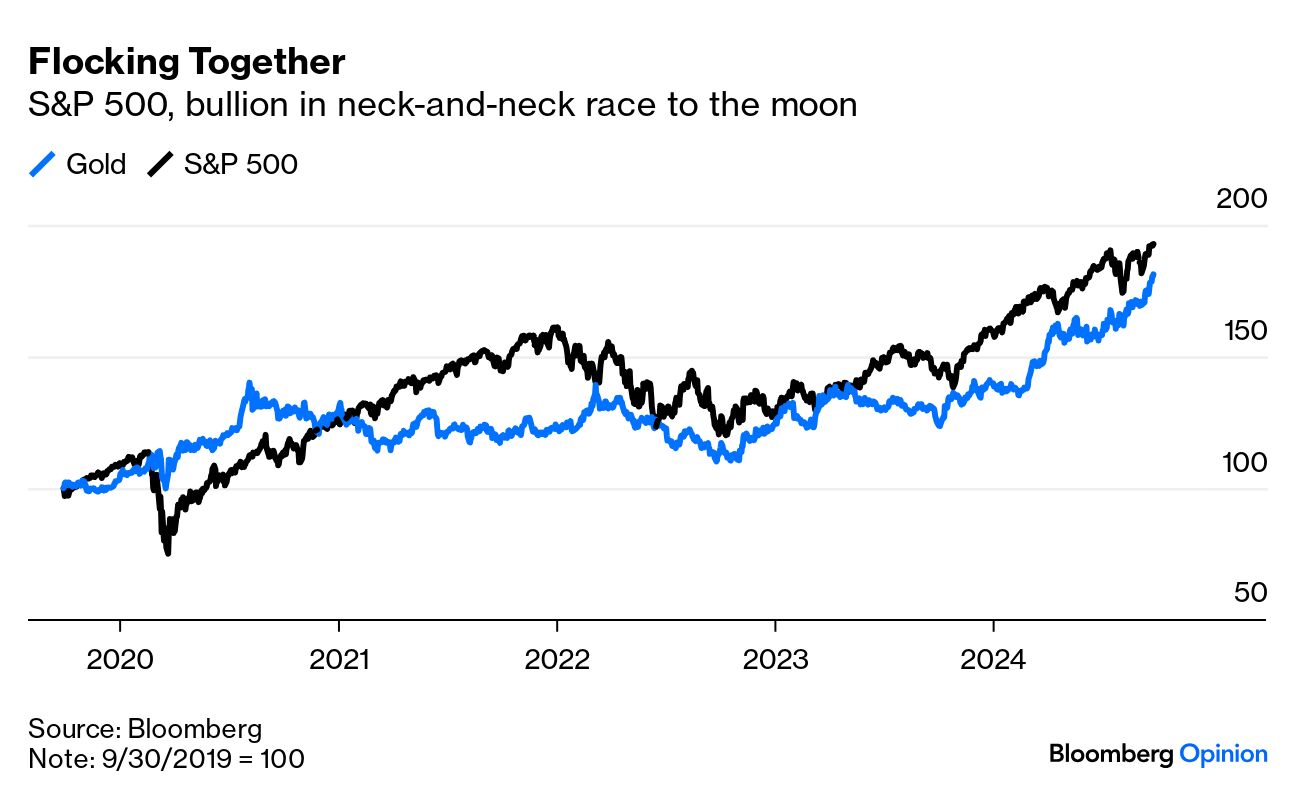

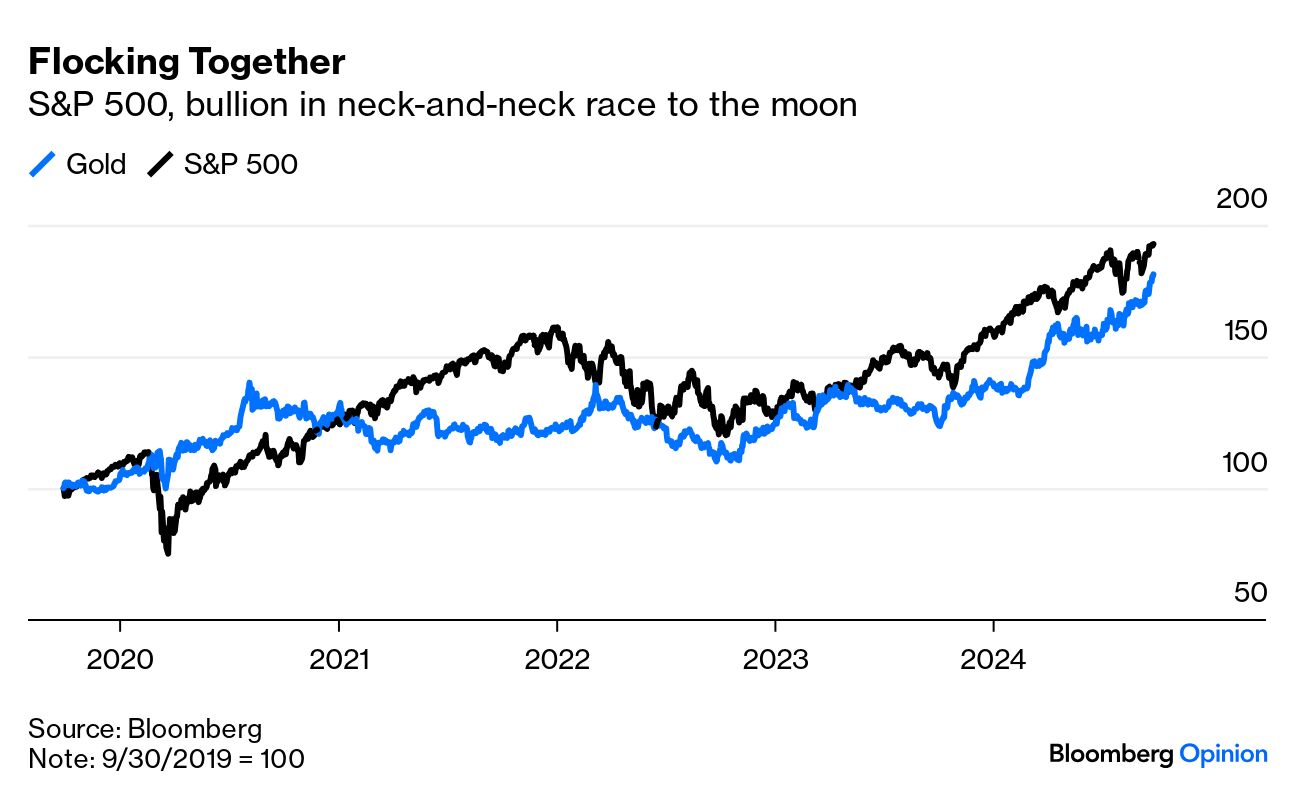

There are enough ironies in the situation to sink the Titanic. World capital markets leap on a diktat from the Politburo of the world's largest communist state; European makers of jewellery and over-expensive handbags benefit more from those communists than anyone else; and the capital establishment is now excited because the communists look as though they're going to get serious about Keynesianism and a welfare state. Which aforesaid communists previously didn't seem to think was a good idea. But it's where we are. China is determined not to allow either housing or share prices to fall further, which removes tail risk from global markets. That's good. It also looks as though it will have a serious go at putting life into its economy, which would bolster everyone's chances of a soft landing. It's done a good job of western-style message management that has revived western confidence. The challenges facing its economy remain, but the forex market bottom line is clear that Beijing needed to act in a way that the Federal Reserve perhaps didn't. As Louis-Vincent Gave of Gavekal Research commented, "When the Fed surprised the market with a bigger-than-expected interest rate cut, the US dollar fell; when the PBOC and the Chinese government surprised the market with a bigger-than-expected stimulus, the renminbi rose." Gold's record-shattering run continues. It topped $2,660 an ounce in Thursday trading, the highest price on record for a commodity that has been prized for millennia. But while that's impressive, it's also a little strange. Bullion's rally in the past week has coincided with the Fed's half-point rate cut. It's usual for the price of safe-haven assets like gold to appreciate as the Fed eases policy. As a hedge against economic downturns and uncertainties, there's a justifiable cause to view the recent surge as a sharp disconnect with growth projections or outlook. Apart from China, the global economic picture looks pretty decent, with recession forecasts no longer the base case for developed and emerging economies. The battle against post-pandemic inflation looks all but done, with central banks worldwide at various stages of easing cycles. This shouldn't be a conducive environment for a barbarous relic to rally, and yet it continues to keep pace with the artificial intelligence-powered S&P 500:  Obviously, more explanation is needed. Historically, the metal's strongest prices compared to the S&P 500 have coincided with the greatest periods of uncertainty — the Great Crash, the Middle Eastern crises of the 1970s, and the Global Financial Crisis. Now is at present nothing like such spikes. But stocks are also failing to outperform an asset that offers no yield. So what gives? Either the equities rally is overdone, or gold is being driven by factors that have little to do with skepticism around economic growth. Here's a chart tracking gold's relative performance, dating back to the Great Crash in 1929:  Angeles Investment Advisors' veteran portfolio manager Michael Rosen agrees that it's hard to pinpoint the factors behind gold's run, although strong demand for physical gold, heightened geopolitical tensions, and the upcoming US elections could all have an impact. Gold's 30% year-to-date rise accelerated after the Fed's cuts and further easing is virtually a given. That would be supportive, but Bank of America researchers suggest gold is overbought, and that prevailing price levels already discount deep Fed cuts: Despite the positive long-term outlook, we highlight some risks today. Prices are 15% above the 200-day moving average. Historically, returns are flat one to six months after trading at such extremes. Gold investors are also already discounting 150-200 basis points of interest rate cuts on our estimation. If Fed cuts are slower than expected, the pace of gold gains could also slow.

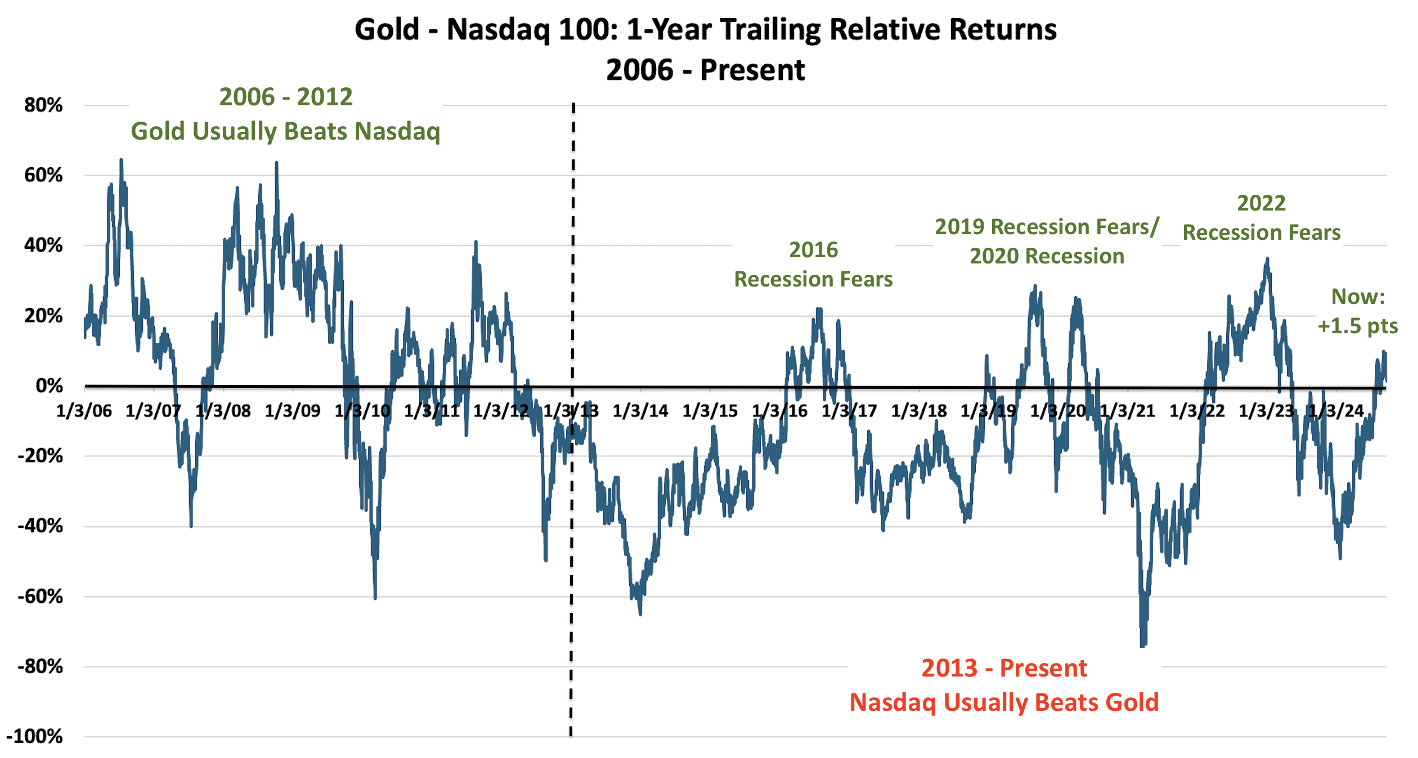

Gold's strong physical demand has come from central banks. BofA estimates that between 2022 and the end of this year, they'll have acquired over 3,000 tons, the fastest clip in history. The stockpiling has come mostly from outside the US, notably China. DataTrek Research's Nicholas Colas explains that bullion is a reasonable alternative to sovereign debt in terms of reserve holdings because it cannot be confiscated or sanctioned. That speaks to rising geopolitical risk, he says, but doesn't portend a near-term economic downturn. With the US economy humming along, it's easy to understate harbingers of recessions. Is it possible gold is flashing warning signs? This DataTrek chart shows the Nasdaq 100 routinely outperforming gold over the last decade, often by 20 percentage points or more over any given one-year period. The exceptions came in 2016, 2019–2020, and 2022, when recession concerns were elevated or a contraction materialized: Why, then, is gold beating the Nasdaq again, when everyone expects a soft landing? Colas says gold's continuing dominance over the last 12 months backs arguments that this is a recession warning that could justify further price increases. XS.com's Rania Gule adds that a fall in Treasury yields to about 3.73% and a weak dollar enhance gold's attractiveness, as holding it becomes less costly compared to investing in bonds. It still pays for investors to keep hold of the guardrails: Despite supportive factors, some risks must be monitored. Investors should be cautious and stay updated on market developments, as a correction could be imminent at any time and could reach significant psychological levels at $2,600 and $2,500 in the near term.

—Richard Abbey One last consignment of songs inspired by R-Star or R*. You could listen to Big Country's 1,000 Stars, Stardom in Acton by Pete Townshend, Stars Fell on Alabama by Billie Holiday (or Frank Sinatra), Starburst by Fontaines D.C., Video Killed the Radio Star by the Buggles, Randy Edelman's To the Stars, The Whole of the Moon by the Waterboys (OK, the moon isn't a star but there are umpteen celestial references in the song), Red Star by Champs, or Starless by King Crimson. For the jazz-inclined, there's John Coltrane's Stardust, Louis Armstrong's (totally different) Stardust, yet another Stardust by Wynton Marsalis, Duke Ellington's StarDust (different again), and Miles Davis' Star People (featuring electric guitars!), Chet Baker's Lonely Star, or Charlie Parker's Star Eyes. Thanks for all the suggestions which have introduced me to some jewels. Have a great weekend.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Daniel Moss: China Adds a Touch of Showbiz to Its Stimulus

- Andreas Kluth: Lebanon Pager Attack Marks a New Era of Intimate Warfare

- Dave Lee: OpenAI Is Just Like the Rest of Silicon Valley After All

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment