| Good morning. Global stocks are rising after China announced new stimulus measures, while tech shares are set to benefit from Micron's strong forecast. Meanwhile oil is lower amid higher production prospects and traders await comments from Fed Chair Jerome Powell. Here's what you need to know — Morwenna Coniam. Want to receive this newsletter in Spanish? Sign up to get the Five Things: Spanish Edition newsletter. European stocks rallied and US equity futures are higher, following gains in Asia after China pledged fiscal stimulus. Nasdaq 100 futures are particularly strong after an upbeat revenue forecast from Micron Technology fueled a rally for the stock. US Treasuries and the dollar are steady. President Xi Jinping and China's top leaders called for sufficient fiscal spending measures to stabilize the beleaguered property sector and "forceful" rate cuts, signaling a growing urgency to arrest the country's growth slowdown. China is also considering injecting up to 1 trillion yuan ($142 billion) of capital into its biggest state banks to increase their capacity to support the struggling economy, according to people familiar with the matter. Micron Technology, the largest US maker of computer memory chips, is on track to gain the most in six months after giving surprisingly strong sales and profit forecasts, helped by demand for artificial intelligence gear. Fiscal first-quarter revenue will be about $8.7 billion, the company said, more than the average analyst estimate. The rosy outlook is the latest sign Micron is benefiting from a boom in AI spending. Orders for a type of product called high-bandwidth memory — which helps develop AI systems by providing more rapid access to massive pools of information -- have added a lucrative new revenue stream for the company and other chipmakers. Oil fell for a second day as Saudi Arabia was reported to be committed to increasing output in December, while factions in Libya reached a deal that could open the way for the return of some crude production. Saudi Arabia is ready to abandon its unofficial oil price target of $100 a barrel in a bid to regain market share, the Financial Times reported, while representatives of Libya's rival eastern and western administrations "initialed an agreement" on steps for appointing the leadership of the OPEC member's central bank, the United Nations said. Today traders are awaiting pre-recorded remarks from Fed Chair Jerome Powell for hints about future monetary policy. It comes after The Fed's Adriana Kugler said on Wednesday she "strongly supported" a half-point cut last week. The central bank's preferred price metric is due tomorrow, along with and a snapshot of consumer demand. Thursday will see the latest data on jobless claims, durable goods orders and revised GDP for the second quarter. This is what's caught our eye over the past 24 hours. - OpenAI is discussing giving Sam Altman a 7% equity stake and restructuring to become a for-profit business.

- Brazil's farmers are plowing over an ancient Amazon civilization.

- Top bankers chase a big payday by defecting to private credit.

- How Northvolt went from being Europe's battery hope to fighting to stay afloat.

- The US election deepens questions about whether Washington will continue its support for Ukraine.

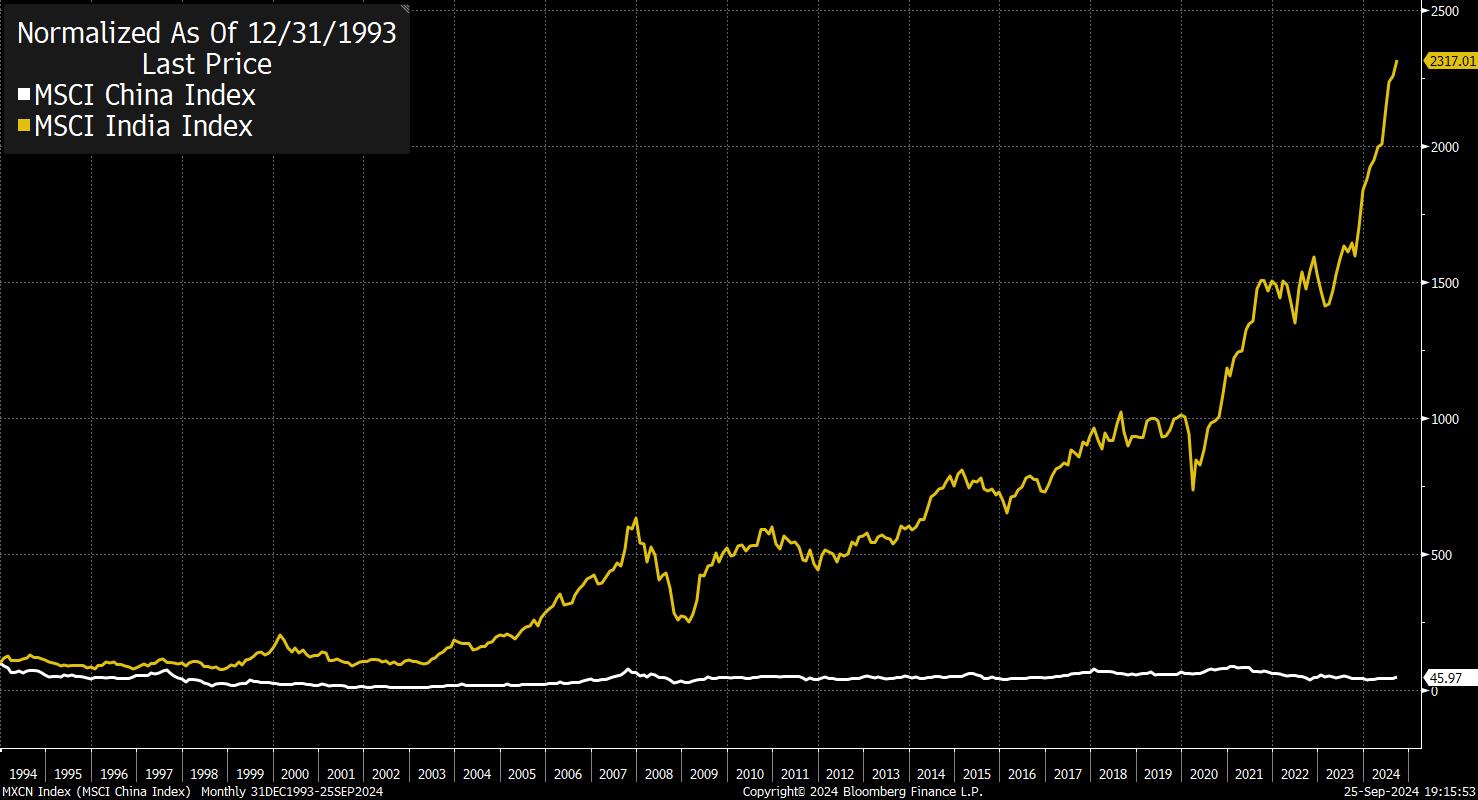

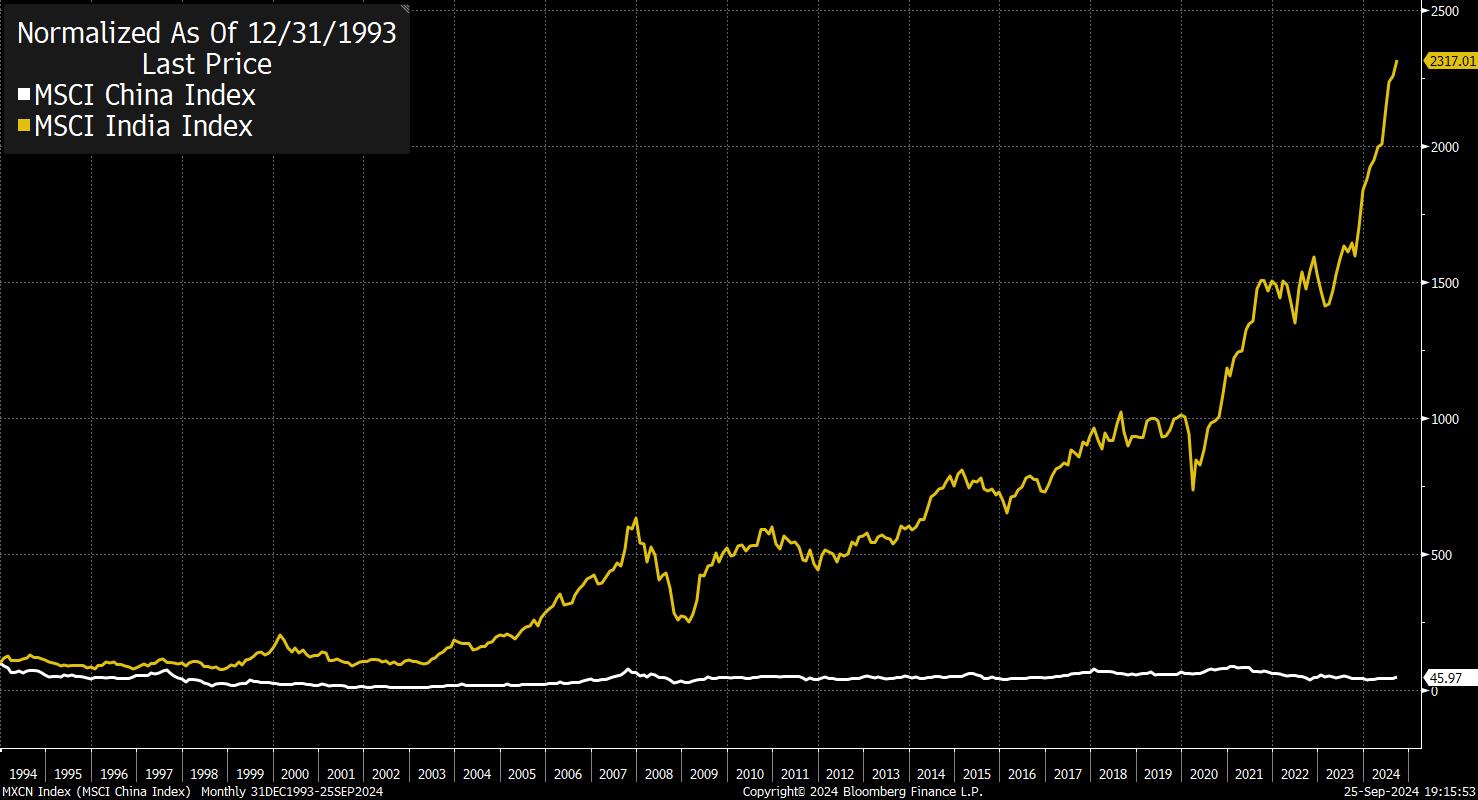

I saw a pretty insane chart on Twitter the other day. Check out the returns on the MSCI India stock market index vs the MSCI China index since 1993.  Chinese stocks have lost you money over the last 30 years, while Indian stocks have given you a gigantic return, at least according to these particular indexes. We all know about the recent struggles of the Chinese economy, but... it's still pretty weird.

Both economies have grown a lot over this time, but China in particular has been one of the most extraordinary economic development stories of all time. And these days, it's non-stop news about how various Chinese companies are at the leading edge of technological development in areas like batteries and EVs.

On the Odd Lots podcast today, Tracy Alloway and I talk to NYU professor Vivek Chibber about economic development and industrial policy. Chibber is the author of, among other books, Locked In Place, which looks at the comparative economic histories of India vs. Korea, and why the latter has seen so much economic success relative to the former in terms of moving up the wealth latter and building cutting edge industries. There are a lot of things that have to go right for industrial policy to work. But one of his key contentions is that if the state is going to direct money to certain industries (give them money for free) then the state needs to be strong enough to guarantee that the money goes to actual investment, rather than into the hands of shareholders. A state that doesn't have this power over its capitalist class isn't going to see the industrial success that it aims for.

With this in mind, it's not hard to reconcile the performance of Chinese industry vs. the performance of the stock market. Companies that are incentivized to constantly invest, constantly build new factories, constantly hire more people, and constantly spend more on R&D are going to be companies that don't return a lot of cash to shareholders. The economy can enjoy the fruits of higher productivity without it necessarily benefitting investors. Maybe one day the leading Chinese companies will enjoy monopoly-like profits in certain industries, and then one day maybe a ton of cash will flow to investors, but right now the story has been non-stop building.

Anyway, it's interesting thinking about the US right now, where we're trying to mimic China, or at least follow China, in certain industries. Our companies have a long history of prioritizing shareholder returns. Stocks that keep going up are important for management. And activists are likely to punish companies that go too long without the line going up. I guess over the next few years we'll see the degree to which the push for more competitive investment can be reconciled with shareholder demands to grow profits.

It was a fascinating chat with Chibber. Find it on Apple, Spotify, or elsewhere. Follow Bloomberg's Joe Weisenthal on X @TheStalwart |

No comments:

Post a Comment