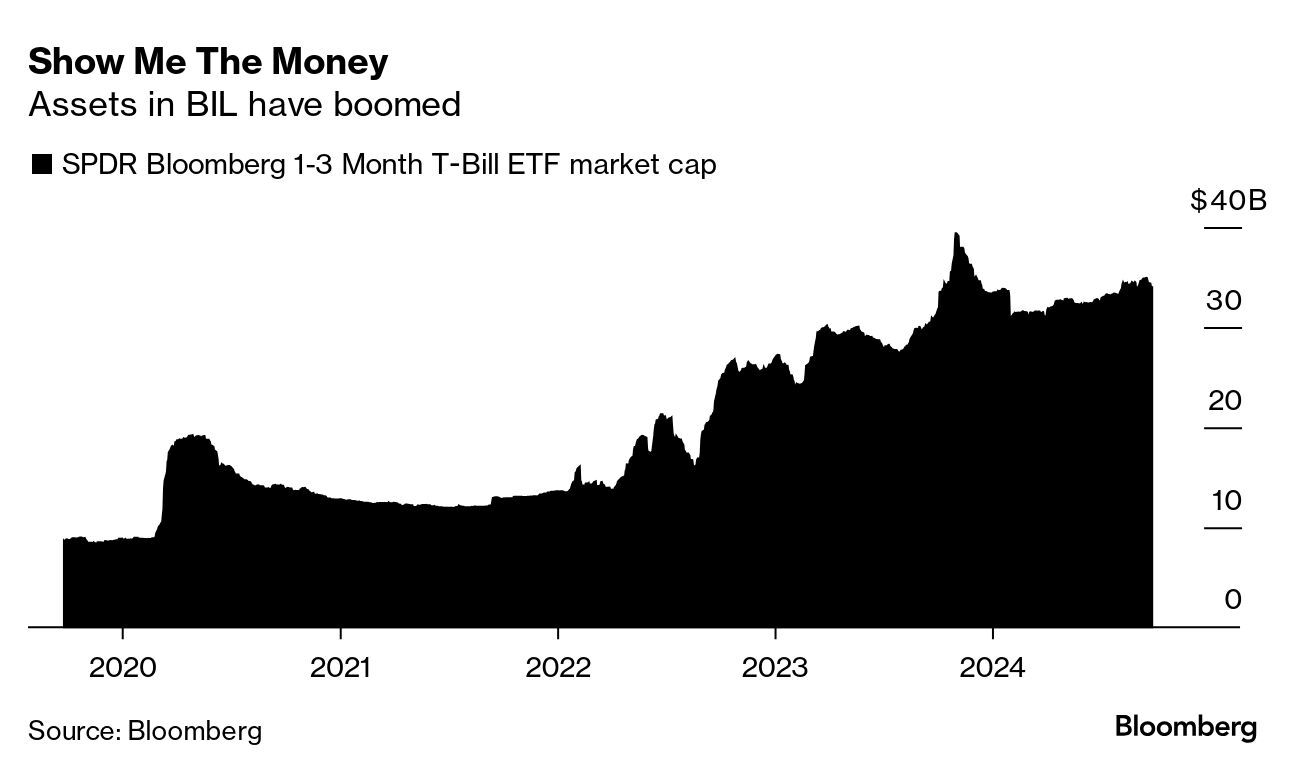

| This week saw the arrival of the first ETF with 'money market' in its name. The industry isn't sure how to feel about it. The Texas Capital Government Money Market ETF, which trades under the ticker MMKT, is the first-of-its-kind in that it follows Rule 2a-7 — a provision of a 1940s Securities and Exchange Commission law that governs money-market funds. It has all the same holdings, too: 99.5% of MMKT's portfolio must be in cash or government securities, with maturities ranging from overnight repurchase agreements to as long as 13 months. However, there is one huge difference between this ETF and your traditional money-market mutual fund: MMKT won't maintain a stable net-asset value of $1. Without that $1 NAV — a staple of all government and retail prime money-market funds — some argue that the fact that MMKT falls under Rule 2a-7 is a distinction without meaning. And it's true, there are plenty of cash-like ETFs on the market. However, existing short-dated bond ETFs have a little bit more wiggle room. Take the $34 billion SPDR Bloomberg 1-3 Month T-Bill ETF (ticker BIL) — while virtually all of the fund's holdings are in short-dated government paper, BIL's prospectus only mandates that at least 80% of its assets be in such holdings. So who is this for? In the eyes of Coalition Greenwich's Kevin McPartland, MMKT could serve as a worthwhile building block in portfolios that hold only ETFs. "One obvious use case I see is if you had a robo-advisor account that used ETFs to create asset class allocations, this could be used for the cash component," said McPartland, head of market structure research at Coalition Greenwich. |

No comments:

Post a Comment