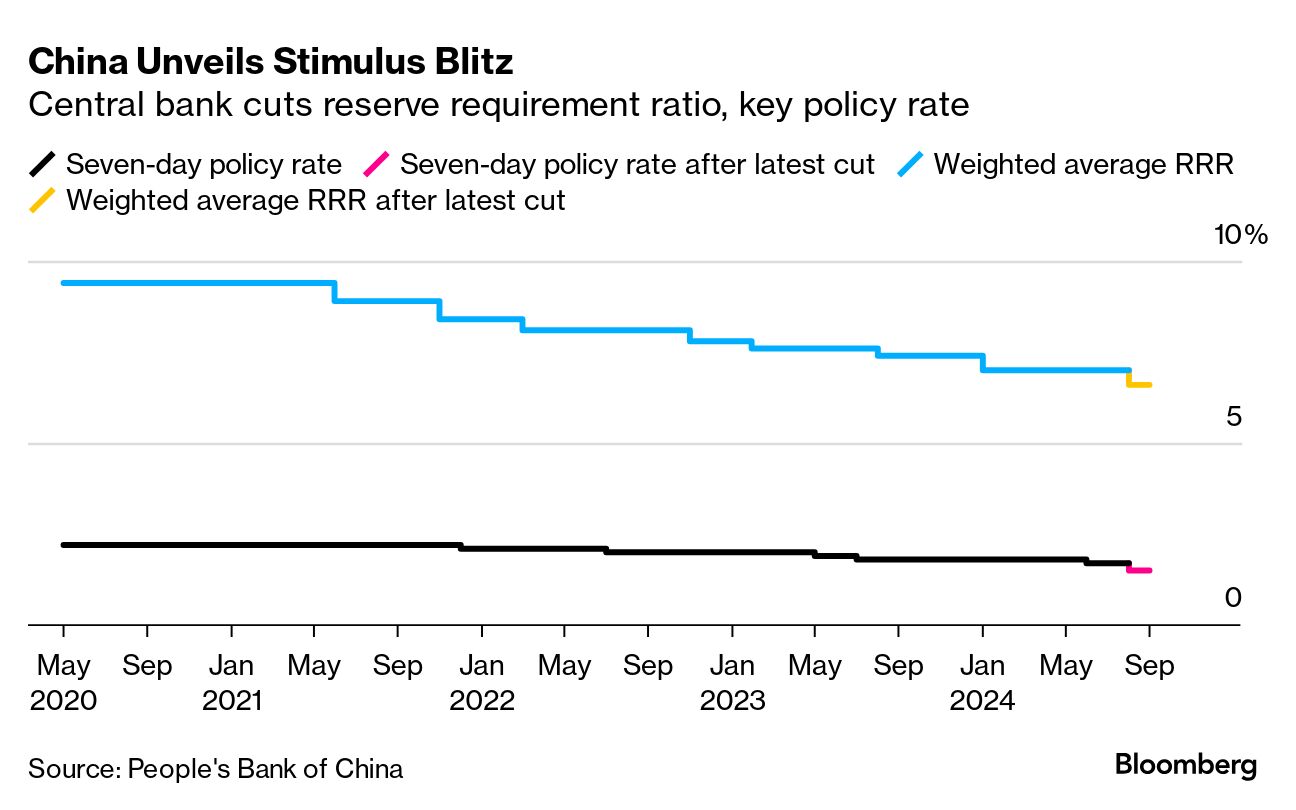

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at policy pivots on both sides of the Pacific. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Last week, the Fed reset the global monetary policy outlook with its larger-than-expected rate cut. This week, China has swung decisively into stimulus mode in an equally momentous move. The Fed's pivot after a 2 ½-year tightening cycle cleared the way for China to roll out monetary, housing and fiscal plans that amount to what Nomura economist Ting Lu describes as "bazooka stimulus." In their latest move on Friday, officials cut the amount of cash banks must keep in reserve and lowered a key policy rate. In the US's market-led economy, Powell's move is designed to ease borrowing costs and thereby filter through the economy to keep labor markets from deteriorating further. In China's hybrid command-style/market economy, the switch will be flicked to "on" more directly. "As saving the economy and rescuing markets (stocks, property…) become politically correct, we believe officials are likely to jump on the bandwagon to display their loyalty. Consequently, we believe more supportive measures will be announced in the next couple of weeks and months by various ministries and local governments," Ting wrote in a note. To Macquarie Securities' Larry Hu, policy has moved to "emergency mode" with a new key performance indicator for property: "Stop the decline." That represents a paradigm shift. Since late 2020, policy makers have taken advantage of strong external demand and booming green energy, solar and EV industries to deliberately take steam out of the property sector, even if that weighed on consumption. No longer. "Given employment and deflationary pressures, policymakers believe that the window to deflate property has already closed," says the Macquarie economist, who had held firm to a gross domestic product growth forecast of 5% for this year in anticipation of stepped-up stimulus, even as counterparts cut theirs. "For a top-down system like China, the change in the property KPI still matters a lot. With it, bureaucrats will exhaust all the policy tools to make it happen," Hu says. Other economists remained cautious. Goldman Sachs's Hui Shan and Andrew Tilton warned there's no quick fix for the property sector and see little upside risk to their forecast for 4.7% GDP growth this year. Potential for the US presidential election to lead to higher tariffs on Chinese goods means there's two-sided risks to the 2025 forecast for 4.3%, they said. UBS's Wang Tao will assess the size and composition of actual fiscal support that could be announced in coming days before revising forecasts. The Fed's cut and weaker greenback give scope for more easing, she said. Bloomberg Economics's David Qu and Eric Zhu, meantime, see a clear upside risk to their 4.7% growth forecast for 2024, with the economy now having a stronger chance of heading into 2025 on a firmer footing. "The longer-term picture, though, still looks the same — grim. Structural forces will keep considerable downward pressure on growth," they wrote. But for now, global markets and billionaire investors including David Tepper are cheering policy moves on both sides of the Pacific that have shifted decisively after years of restrictive settings. - Fed Governor Lisa Cook said she "wholeheartedly" supported the central bank's move last week to cut rates by a half percentage point.

- France's status as one of the safest bond markets in Europe risks coming to an end as a fragile government struggles to address its debt problems.

- A year into her term as Australia's central bank governor, Michele Bullock is facing headwinds on multiple fronts that are set to intensify.

- The worst drought in more than a 100 years is testing Zambia to the limit.

- India's central bank watchers are getting anxious about who will set borrowing costs in two week's time as the governor's term is set to end.

- Mexico's central bank reduced rates, Sri Lankan officials held them, and Ghana is expected to cut today for the first time in eight months.

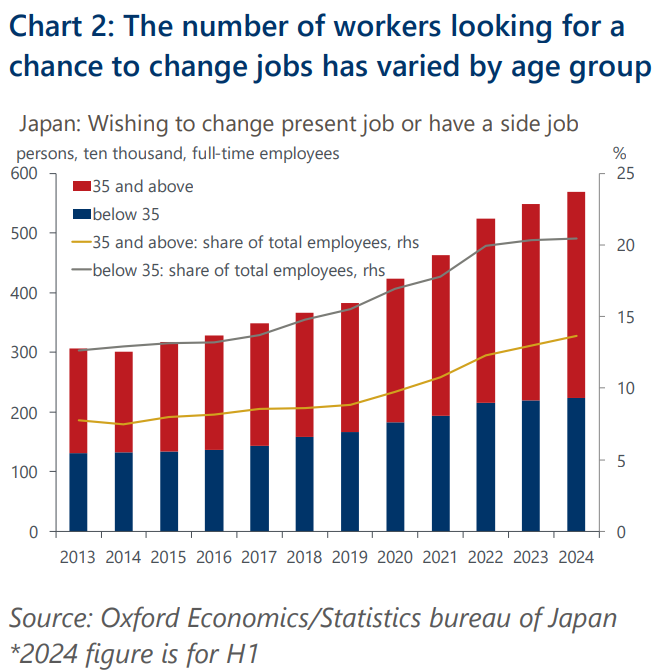

An increasing number of Japanese full-time workers have been switching to other full-time jobs in a structural shift away from the nation's classic "lifetime employment" system. Over time, it will help bolster wage gains and productivity, according to Oxford Economics. The old system's drawbacks included encouraging workers to focus on skills and knowledge that were specific to their industry and company – making it harder for them to switch jobs, Shigeto Nagai, head of Japan economics at the firm, wrote in a note Wednesday. As businesses over time cut their budgets for training and education, that "resulted in the underdevelopment of skills and knowhow with market value," he wrote. Skill mismatches will eventually come down as Japan's system changes. The shift of labor "from low-productivity industries to high-productivity industries will gain pace," if only gradually, Nagai wrote. |

No comments:

Post a Comment