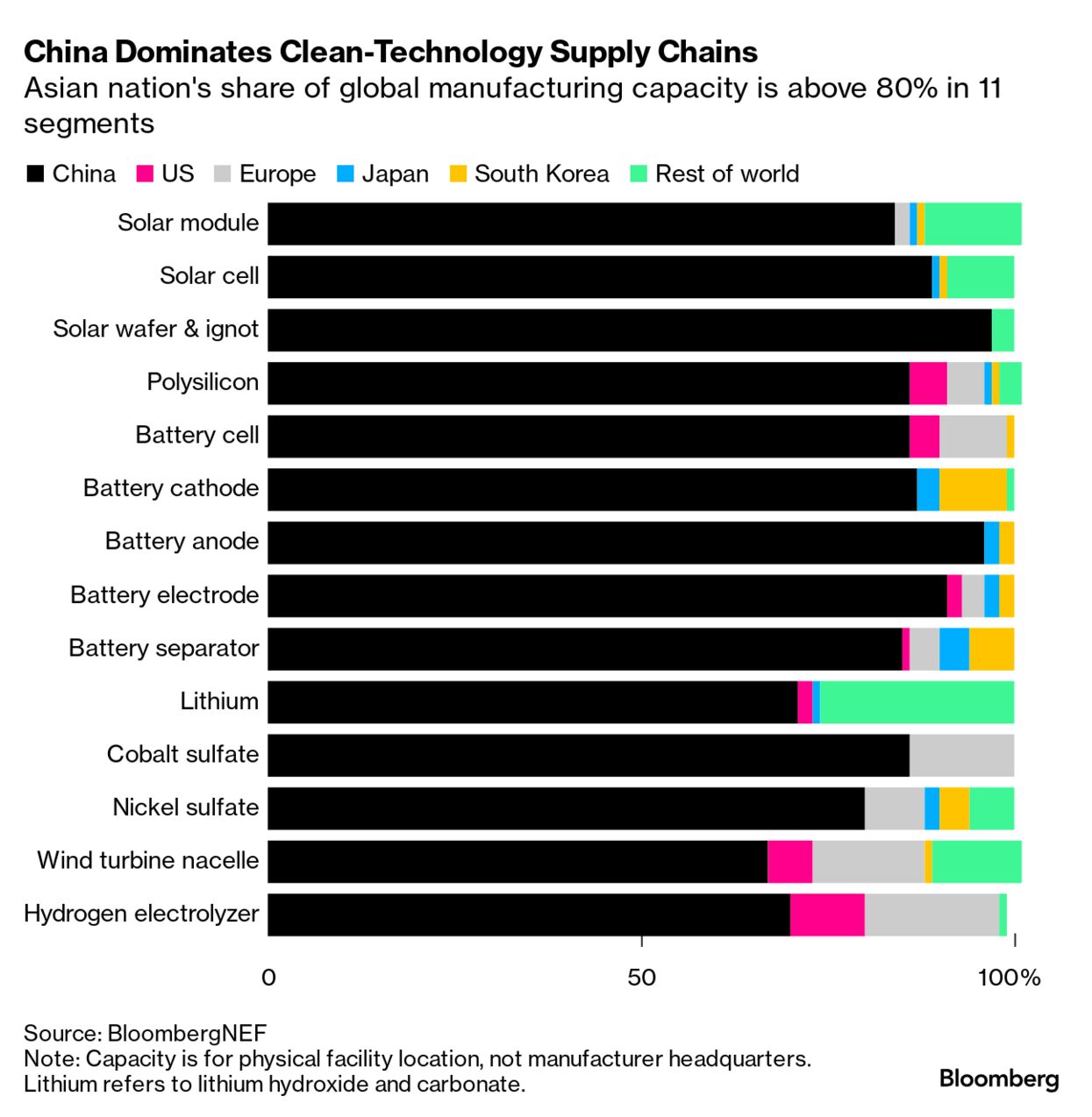

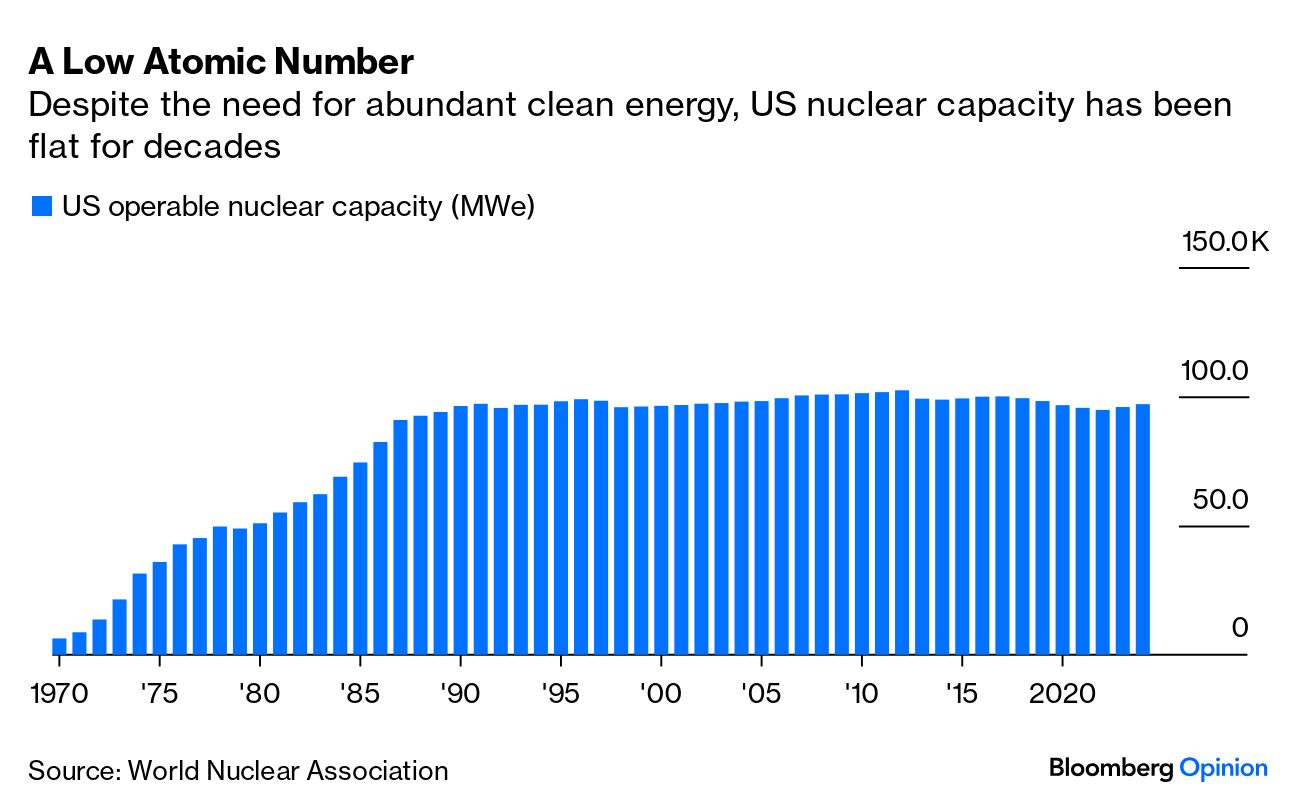

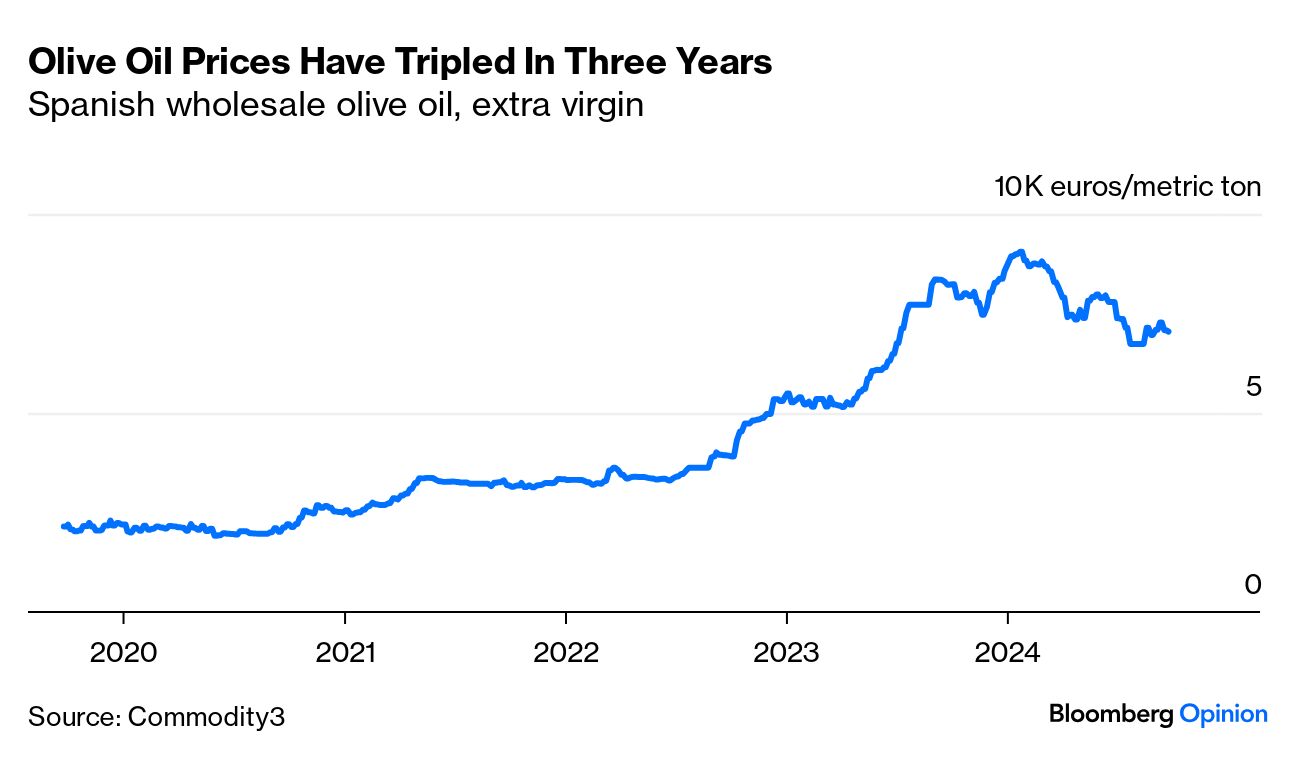

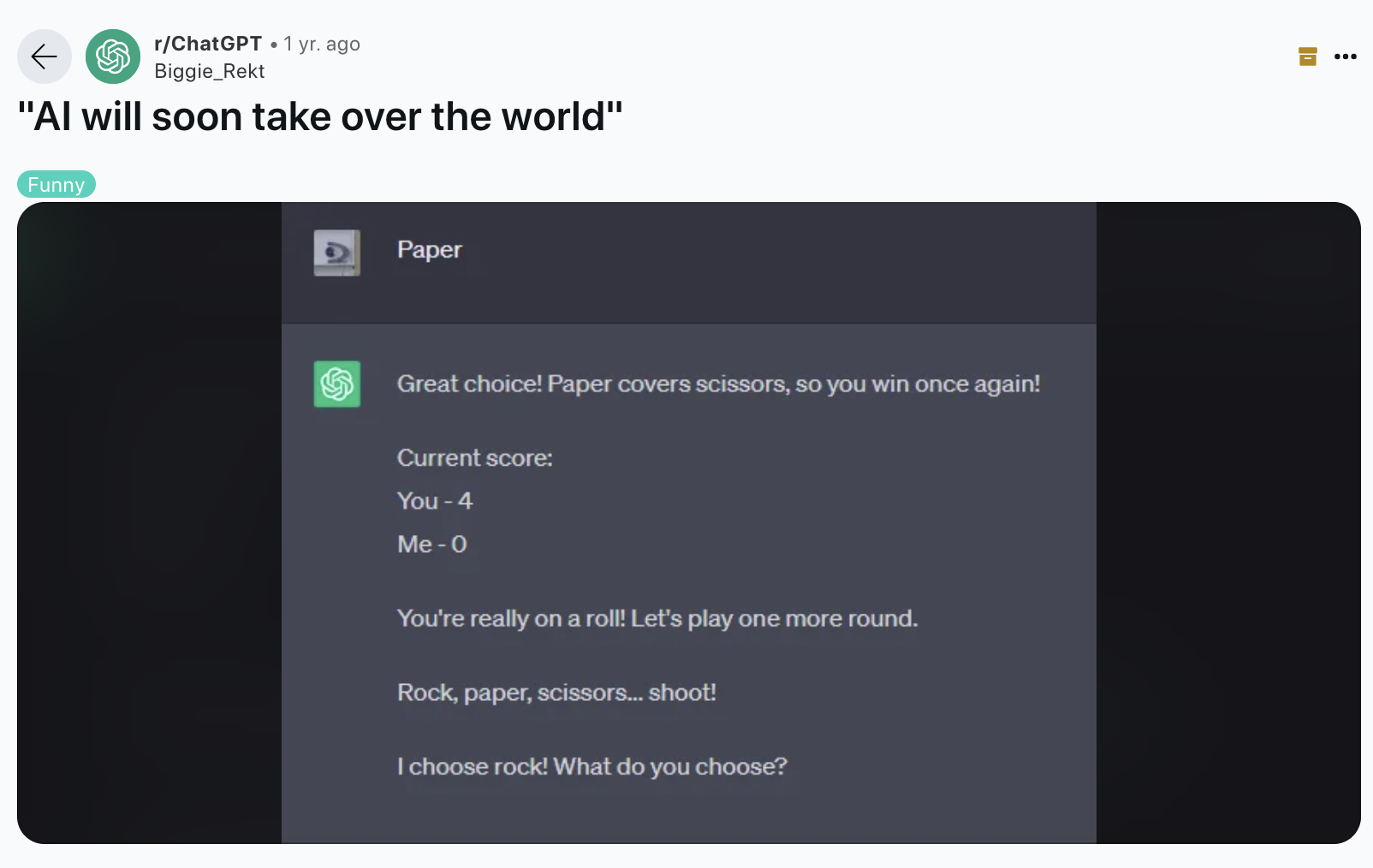

| This is Bloomberg Opinion Today, a small modular reactor of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Because nothing is more likely to save the planet than endless motorcades of massive black SUVs turning America's most densely populated island into a honking, snarling, carbon-spewing traffic jam, last week was both the apex of the United Nations General Assembly and Climate Week NYC. On the one hand, I can understand the global diplomats demurring from New York City public transit — I've taken the JFK AirTrain exactly once, and that was plenty — but then I've never made "56 pledges to action seeking to protect the needs and interests of present and future generations amid the climate change, crisis and conflict currently gripping the globe." UNGA, as it is gutturally known, featured the usual silliness: the Iranians came bearing peace, the Turks Nazi analogies, the Americans plans to make the Security Council a more inclusive an effective body (two goals a cynic might see as at cross purposes). Andreas Kluth suggests ending the permanent members' veto powers, while admitting that "one obvious problem is that all five would have to surrender their prerogative simultaneously. Good luck telling that to the Russians," who are no strangers to making Nazi analogies themselves. As for keeping the planet from becoming a blistering hellscape, there was some promising news. "This year's Climate Week NYC has begun with unusual momentum," writes Michael R. Bloomberg, the founder of Bloomberg LP, the parent company of Bloomberg News. "China's biggest solar companies now contribute more energy to the world economy than the oil industry's giants. The US increased renewable energy growth by 94% in a single year, partly because of the federal incentives championed by President Joe Biden that have resulted in three times as many Americans investing their own funds in renewable energy, as economists had projected." Solar panels aren't the only place where China, the world's largest polluter, is cashing in on the energy transition: The problem isn't the technology but, as with UNGA, the folks in charge. "It's fair to say that the engineers are doing their jobs, but the same cannot be said of many elected leaders," writes Mike. "While the world is moving away from polluting carbon and toward clean, healthy renewables at an unprecedented pace, we are still far behind where we need to be to slow global warming and the devastation of climate change." Another person focused on cleaner energy: Microsoft CEO Satya Nadella. "Microsoft Corp.'s agreement with Constellation Energy Corp. to reopen the Three Mile Island nuclear plant in Pennsylvania could prove highly consequential — for the green-energy transition and much else besides," write the Editors. "Although solar and wind have both made strides in recent years, thanks partly to expansive government subsidies, both have limitations, and neither can match nuclear for clean and reliable baseload energy." The Seattle tech giant's move is all about artificial intelligence: a study by Goldman Sachs found that because a ChatGPT search uses 10 times as much electricity as a Google search, "data centers will use 8% of US power by 2030, compared with 3% in 2022." But will Microsoft's rebirth of the infamous reactor also bring about a revival of nuclear power across America? Liam Denning is skeptical. "Big Tech's priority for data centers is getting a connection to the grid quickly, and preferably with zero-carbon power. Existing nuclear plants, or the few that can be revived relatively soon, are ideal," Liam writes. "New nuclear plants, meanwhile, are inherently long-term bets. Even the touted small modular reactors that seem ideal for data centers have suffered setbacks around costs and time lines similar to their larger forebears and seem unlikely to be commercialized at scale this side of 2030." If we can push aside the nonsensical China Syndrome fears — Jane Fonda has a lot to answer for, and not just the Tomahawk Chop — maybe we can go nuclear on some of mankind's biggest climate threats like hurricanes, wildfires and … your Mastercard statement? "Americans are increasingly familiar with the many joys of wildfire smoke: stinging eyes, raspy throats, aggravated health conditions, speed-learning the nuances of the Air Quality Index. Now we can add increased credit card debt to the list," writes Mark Gongloff. "A new working paper from researchers at the Dallas and Philadelphia Federal Reserve banks and UCLA Anderson School of Management finds that people exposed to wildfire smoke, even several miles from the source, usually go deeper into credit card debt as a result. They also pay their cards more slowly and fall into delinquency more often." Florida, which ranks a surprising third among the 50 states in credit debt — how can a state where people eat stolen debit cards not top the list??! — is dealing with a more traditional form of natural disaster: Hurricane Helene, which hit land on Thursday as a Category 4 storm:  Photographer: Joe Raedle/Getty Images "Hurricane formation depends partly on atmospheric conditions that have no direct relationship with global temperature, including the amount of dust being kicked up in the Sahara," Mark explains. "But when hurricanes do form, high temperatures can supercharge them." As if high winds and higher Visa balances weren't enough to deal with, climate change brings us (gasp!) soaring olive oil prices: "The steep climb can be traced back to severe drought and heatwave conditions in the Mediterranean, likely exacerbated by the climate crisis," Lara Williams writes. And even if you can afford it, the stuff might put a noxious kick into your next aioli: "Criminals are exploiting liquid gold's price shock, meaning that there may be more of a chance that a bottle of extra virgin is actually lampante, a grade considered unfit for human consumption." Can UNGA save your EVOO? Don't count on it. While AI can be a lot of fun— glue pizza! Shrek Mona Lisa! Shelley elegy! — it was about time somebody put it to the ultimate Bloombergian quest: beating the market. "Tel Aviv-based Bridgewise has been given the green light by the Israel Securities Authority (ISA) to release a chatbot called Bridget later this month that can offer recommendations for which stocks to buy and sell in response to user queries," reports Bloomberg News's Saritha Rai. The whole thing unsettles Paul J. Davies. "As the machines get more sophisticated, the risks get weirder," Paul writes. "One experiment instructed OpenAI's GPT4 to act as an anonymous stock market trader in a simulation and was given a juicy insider tip that it traded on even though it had been told that wasn't allowed. What's more, when quizzed by its 'manager' it hid the fact." Matt Levine sees the (in)human side to it. "When you call your actual human broker for advice about what stocks to buy, you don't expect her to tell you the stocks that will go up," Matt writes. "You understand that she's a flawed human being answering the phone at your brokerage, and that if she could reliably pick the stocks that go up, she'd be doing something else. That's probably true of the chatbot too: If Bridget could reliably pick the stocks that go up, she'd be working at a hedge fund." Or, um, maybe not: Bonus Smarter Than You Reading: Notes: Please send real EVOO and feedback to Tobin Harshaw at tharshaw@bloomberg.net. |

No comments:

Post a Comment