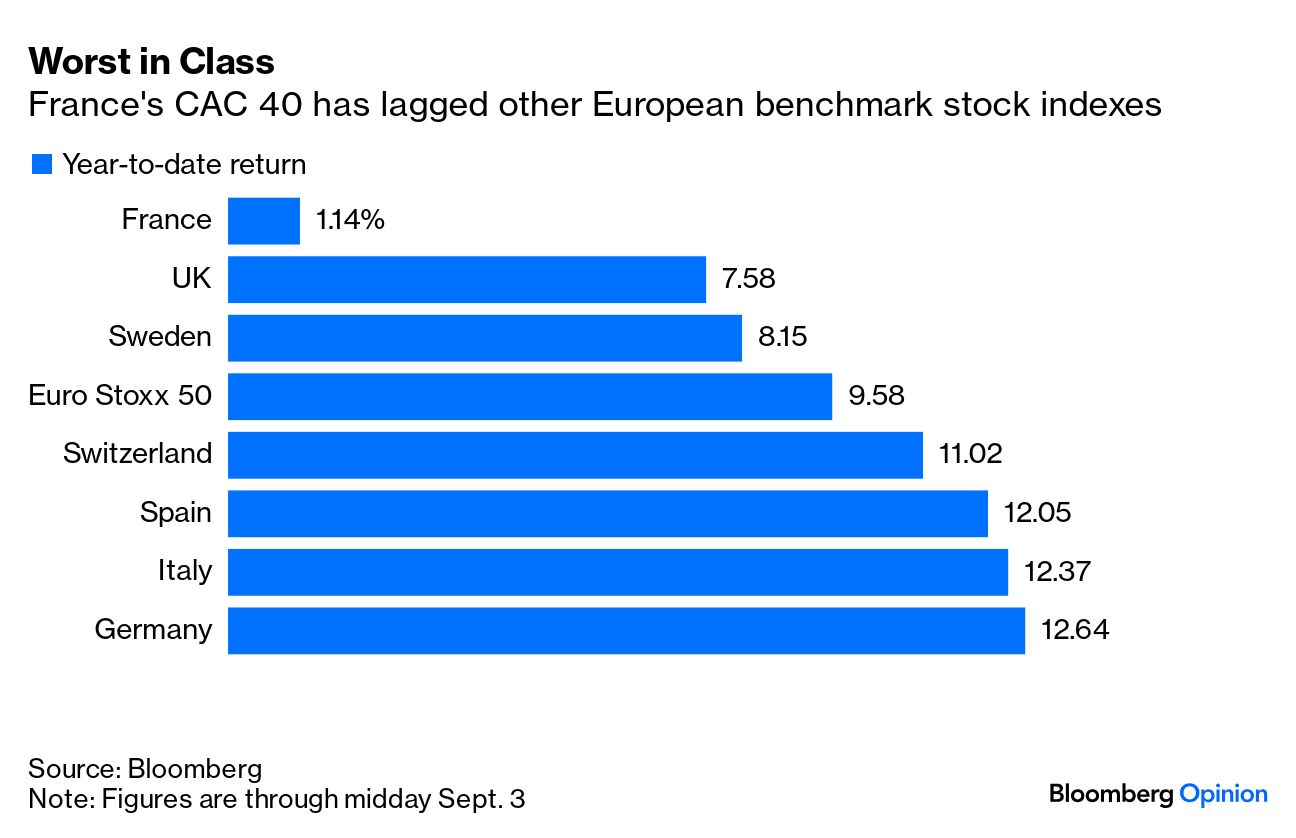

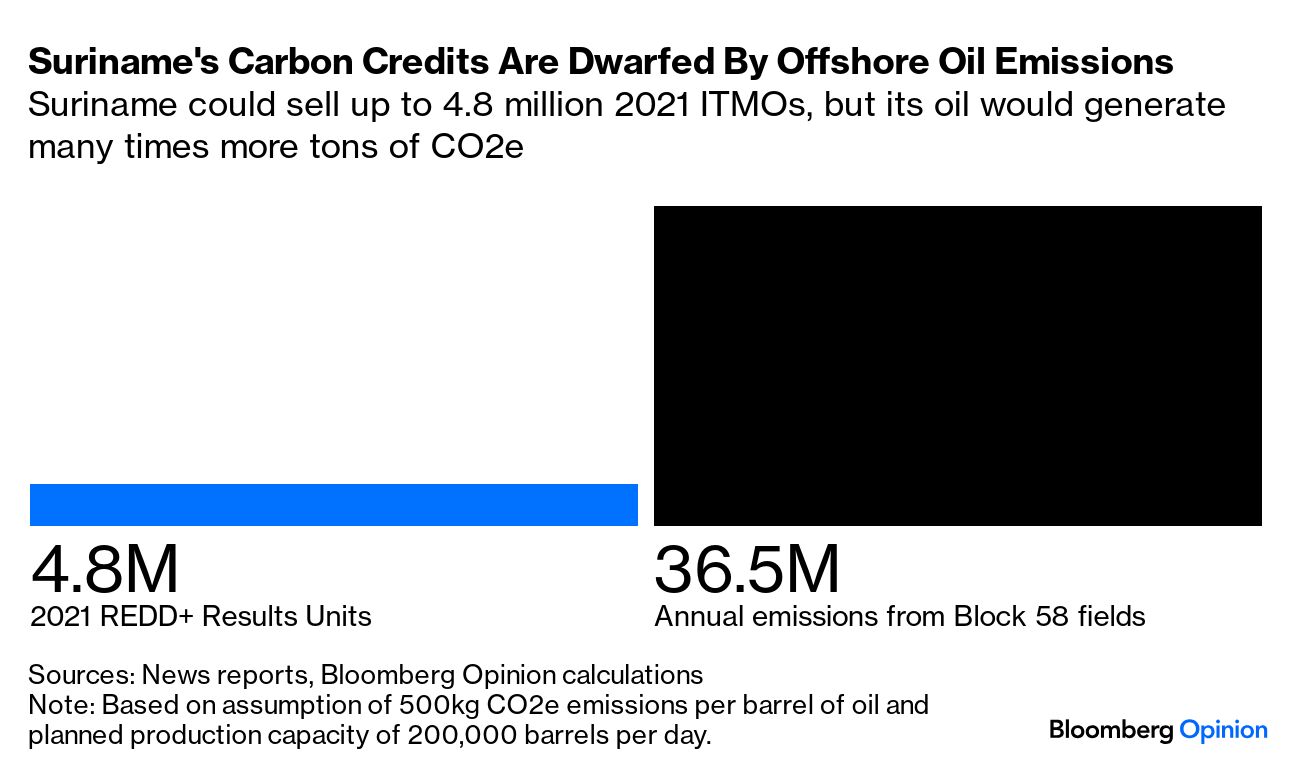

| I'm Justin Fox, and this is Bloomberg Opinion Today, a multigrain assortment of Bloomberg Opinion's opinions. Sign up here . These are lean(ish) times for Cargill Inc., the Wayzata, Minnesota, food giant that is America's largest privately held company. After hitting all-time highs of $4.9 billion in 2020/2021 and then $6.7 billion in 2021/2022, the company's net profit for the fiscal year that ended in May was the lowest since 2015/2016. It still amounted to $2.5 billion, a number that Javier Blas got from an insiders-only report. Cargill will survive, and surely thrive again before all too long. But for the members of the Cargill-MacMillan family who own its shares, the company's profit decline means a sharp drop in dividend payouts that averaged about $1 billion a year over the past three years. "For lesser clan members, who rely heavily on dividends," Javier writes, "it would be a shock." For the rest of us, this turn of events might best be described as a pleasant surprise. "What's bad news for Cargill is typically good news for everyone else," Javier writes. Those record Cargill profits were earned during period of high and rising commodity prices. Now the grains that are the heart of the company's business have fallen in price by 50% — which is beginning to put downward pressure on food prices and help reduce overall inflation. It's not just grains. Oil prices are also near their lowest lowest levels since Russia's invasion of Ukraine sent prices skyrocketing early in 2022.  This second chart is from John Authers, who points out that, with geopolitical tensions not exactly going away, the price drop "implies that global demand is very weak." Which brings me to an important exception to the rule that bad times for commodities kingpins are good times for everybody else. If the prices of grains or oil or metals are falling because the global economy is tanking, that's not really good news for anybody. But if, say, oil demand is weak because so many Chinese drivers have opted for electric vehicles, and grain prices are low because US corn and soybean crops are headed for record harvests, that's great unless you have commodities to sell. With financial markets starting off September in dismal fashion — the main focus of John's column — it seems there's still a lot of uncertainty about whether we're in the good kind of commodities downturn or the bad kind. Bonus food/fuel reading: This summer, the Istanbul-based International Doner Federation petitioned the European Union to impose strict rules on what may be called "doner" or "doner kebab." This brought loud protests from Germany, where Turkish immigrants began serving up the vertically roasted, horizontally sliced cutlets of meat to eager customers half a century ago, and Doner im Brot (in bread) has become a de facto national dish. Restaurants offering "German doner" can now also be found in other European countries — including the UK, where Howard Chua-Eoan lives — and Howard is skeptical of Turkish attempts to rein in this phenomenon.  A German doner kebab house in London. Photograph by Howard Chua-Eoan/Bloomberg If successful, he argues, the effort would "probably set off kitchen revolts all over the Balkans, the Middle East and North Africa," where dishes originating in the Ottoman Empire (the heart of which is now Turkey) were adapted into local staples. In general, culinary innovation does not and should not respect national borders — for example, Pad Thai, now a staple in Thai restaurants worldwide and a symbol of national unity in Thailand, evolved from Chinese-immigrant recipes in the 1940s. Supreme Court justices nominated by Donald Trump during his first term as president provided the decisive votes in overturning the 1973 Roe v. Wade decision, a long-time goal of the anti-abortion movement. As he runs for a second term, though, Trump has careened from backing further crackdowns on abortion to offering support for abortion rights — and back. His flip-flopping has caused great distress among anti-abortion activists, and they're right to be worried, says Francis Wilkinson. The end of Roe v. Wade that Trump enabled, and the strict state abortion bans that followed, have clarified the issue for many Americans, with 63% now saying that abortion should be legal in most or all cases. The Republican nominee's unwillingness to make a consistent case against abortion, along with what Francis calls "the moral degradation that Trump supplies to every endeavor," may weaken the anti-abortion cause even further. Bonus reproductive-rights reading: Birth control methods such as intrauterine devices have been targeted by some anti-abortion groups too, but a bigger problem right now for IUDs is that getting them replaced can be so painful. It doesn't have to be that way, writes Lisa Jarvis, and the medical establishment is finally starting to take note. France's CAC 40 equity index has had a terrible year relative to its European peers, and the country's bond yield premium over Germany has remained abnormally high since President Emmanuel Macron called a surprise election in June. With government budget deficits still growing, the economy still sputtering and politics still unsettled, Marcus Ashworth does not see better times in the offing. Tropical rainforest covers approximately 93% the South American nation of Suriname, making it one of the few countries on earth that absorbs more carbon dioxide through its forests than it emits by other means. Suriname is hoping to cash in on this state of affairs by selling carbon credits, writes Lara Williams. But it's also hoping to cash in on offshore oil reserves that, when burned, will generate far more carbon dioxide annually than its forests absorb. The Internet of Things is a bust. —Adrian Wooldridge AI culture will be weird. —Tyler Cowen Texas is the new Arizona. —Mark Gongloff Election predictions are noisy. —Aaron Brown An unconvincing antitrust case. —Chris Hughes Hedge funds hedge. —Matt Levine Back to the office, federal workers. —Bloomberg's editorial board Biden to block US Steel takeover. New ETF will buy index rejects. Andreessen Horowitz ditches Miami. Verizon in talks to buy Frontier. Blood plasma is a leading US export. No singing for Amazon drivers. Internet Archive loses ebook appeal. Notes: Please send doner kebab and feedback to Justin Fox at justinfox@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment