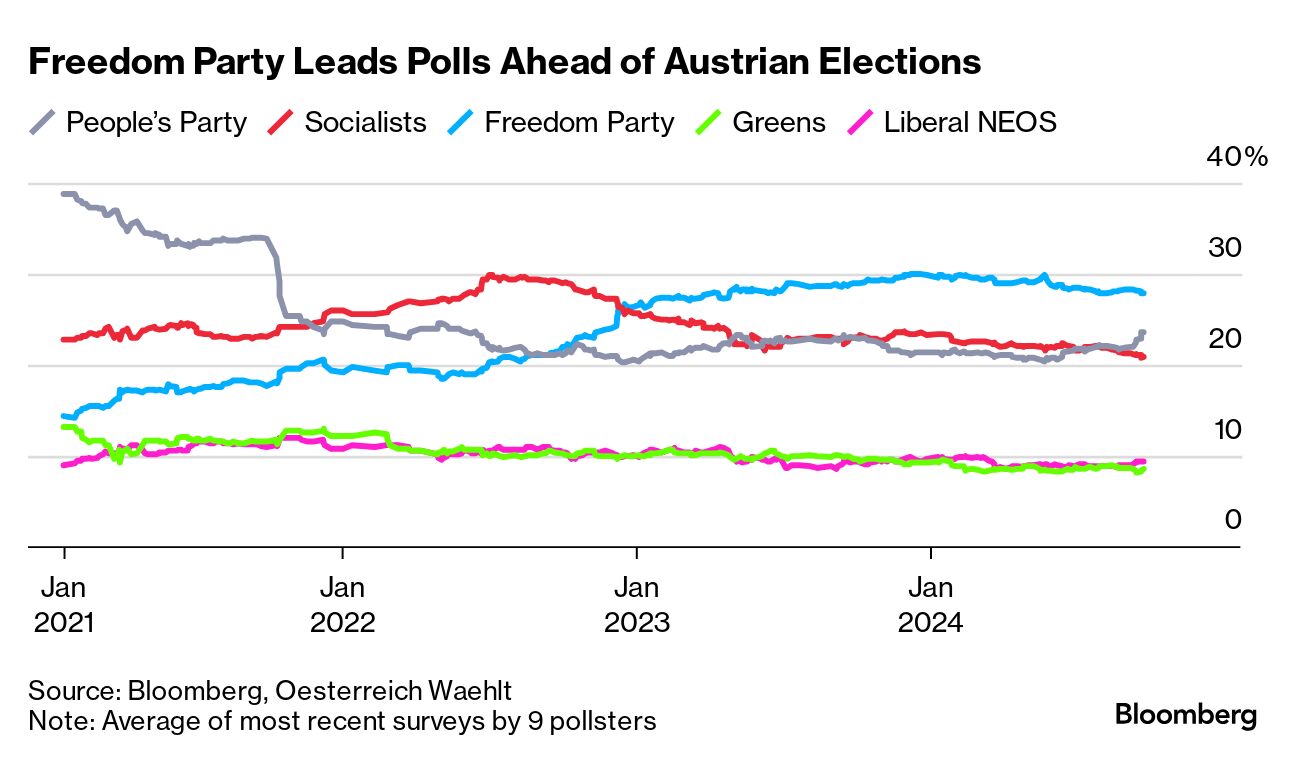

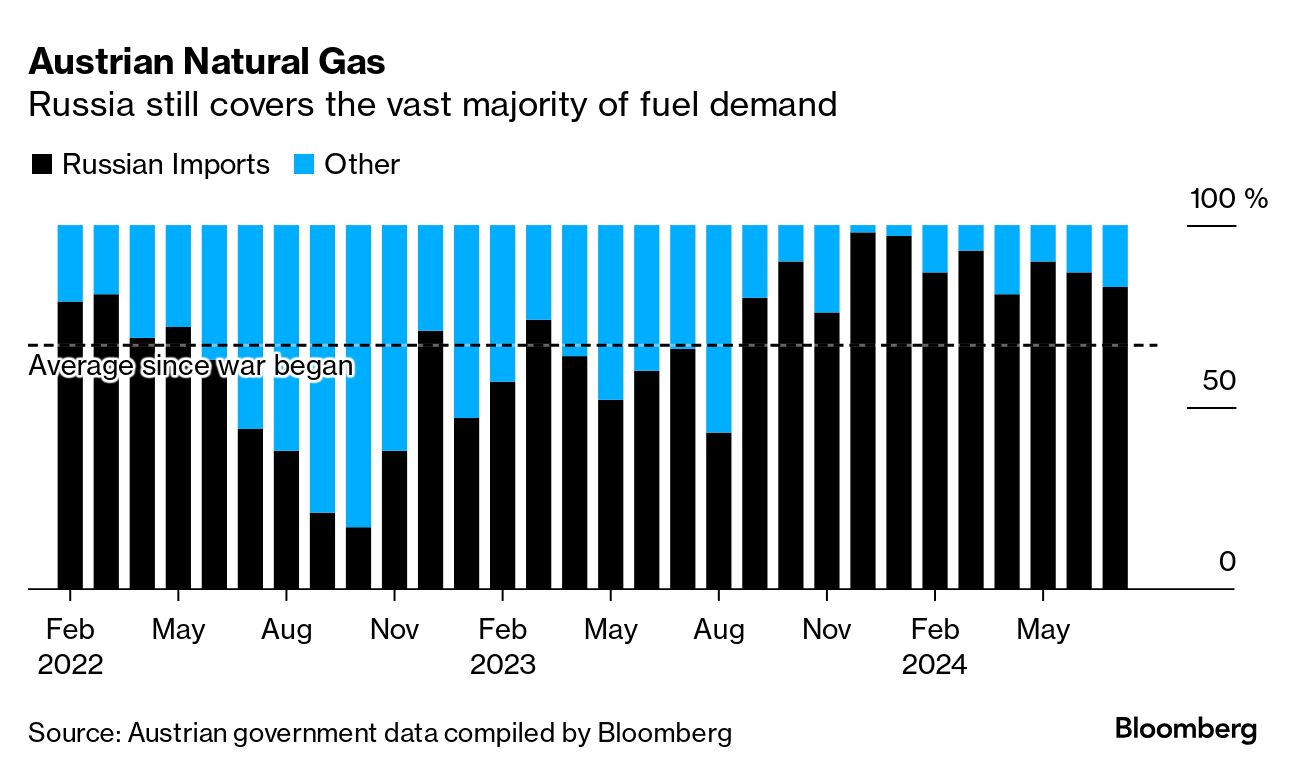

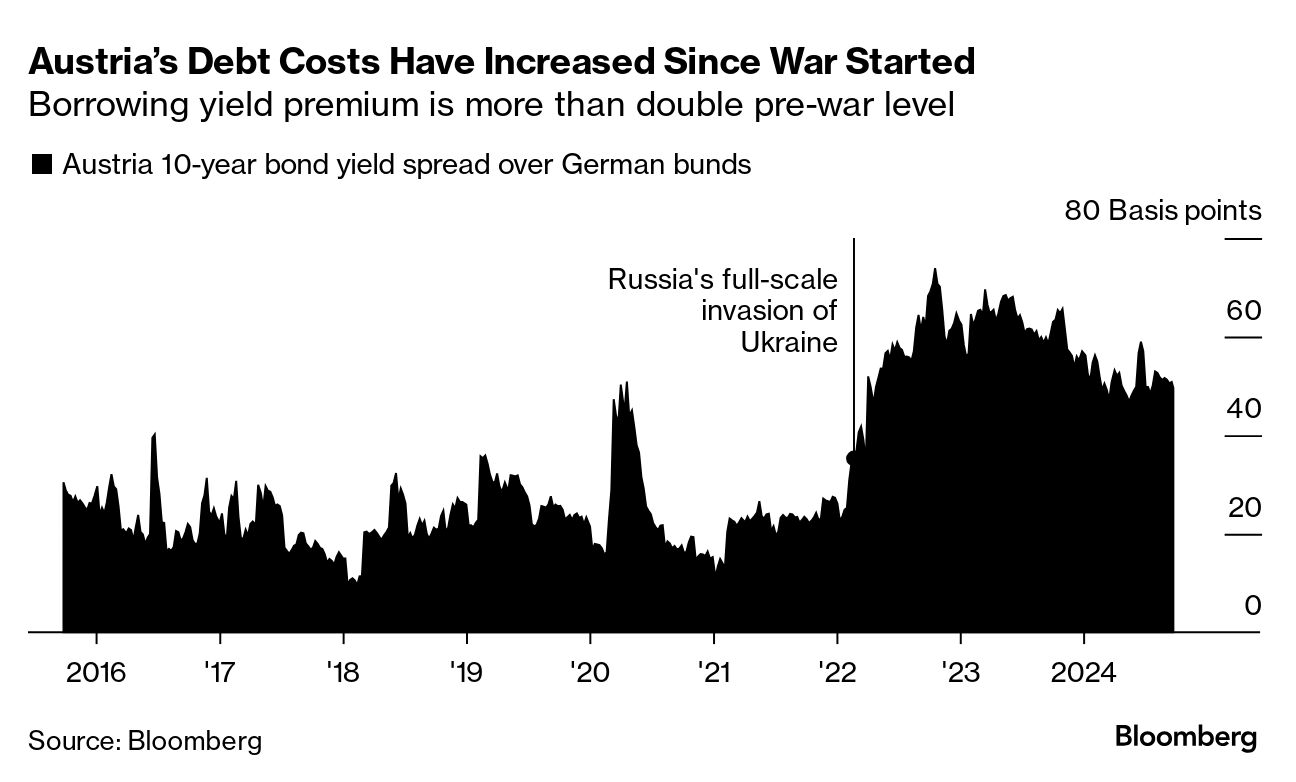

| Welcome to the Year of the Elections, Bloomberg's newsletter on the votes that matter to markets, business, and policy amid the most fragmented geo-economic landscape in decades. For five years, Austria's political elite has been trying to beat the hangover from a booze-infused night in Ibiza. It's been a long bout of collective soul-searching since a woman posing as a Russian oligarch's niece caught the far-right Freedom Party's vice chancellor trading government contracts for campaign funds on camera, leading to his ouster and snap elections. But in a society where political intrigue is an integral part of Vienna's centuries-old coffee house culture, the Freedom Party seems to have put the scandal behind it better than its competitors who've been drawn into a wide-ranging probe. After the resignation of two chancellors, multiple criminal investigations, two lengthy parliamentary committees, a theater play, at least three books and as many films, the Freedom Party is set to win the most votes in Sunday's federal elections after coming close to challenging the top parties twice before. At the heart of the revival is Herbert Kickl, the 55-year-old party chairman. He's mostly been able to turn the page on the incident and avoid the gaffes of his predecessors, the late Jörg Haider and Heinz-Christian Strache. Kickl's rise fits a Europe-wide trend of advances for radical forces. But Kickl has had the benefit of leading a party, that, unlike its German and French peers, has been a mainstay of Austrian politics since it regained independence in 1955. Its climb to the top is mostly a consequence of graft investigations that toppled conservative whiz-kid Sebastian Kurz in 2021. Kickl has brought the term remigration — seen as a euphemism for mass deportation of non-white people — into the political mainstream, and capitalized on discontent over some of the euro area's fastest inflation rates and opposition to a short-lived coronavirus vaccine mandate. Yet what's been a two-year-long campaign to maintain a strong lead in public opinion polls may ultimately fall short of winning Kickl the chancellorship. He remains a toxic presence for all other political forces, and Chancellor Karl Nehammer of the conservative People's Party has vowed not to form a government with him — though hasn't ruled out an alliance with his party. That heralds a messy round of coalition talks, likely including the conservatives, who haven't been out of government since 1987. A centrist government would probably need backing from the People's Party, the Social Democrats and a smaller third group — the liberal NEOS or the Greens. Finding common ground for a coalition program will be an arduous task, even in a nation long used to consensual rule between its two historical parties. Should a late boost for Nehammer — helped by his management of recent flooding across Austria — propel him to an unlikely victory, he may ultimately pick the Freedom Party as a coalition partner, with a diminished role for Kickl. Whatever the outcome, the next years are set to be volatile. For a nation that's in dire need of confronting major challenges — bolstering a weak industrial base as well as redefining relations with Russia and an emerging eastern Europe — that's unlikely to be the best political footing. — Marton Eder  Kickl kicks off his campaign in Graz on Sept. 7. Photographer: Alex Halada/AFP/Getty Images |

No comments:

Post a Comment