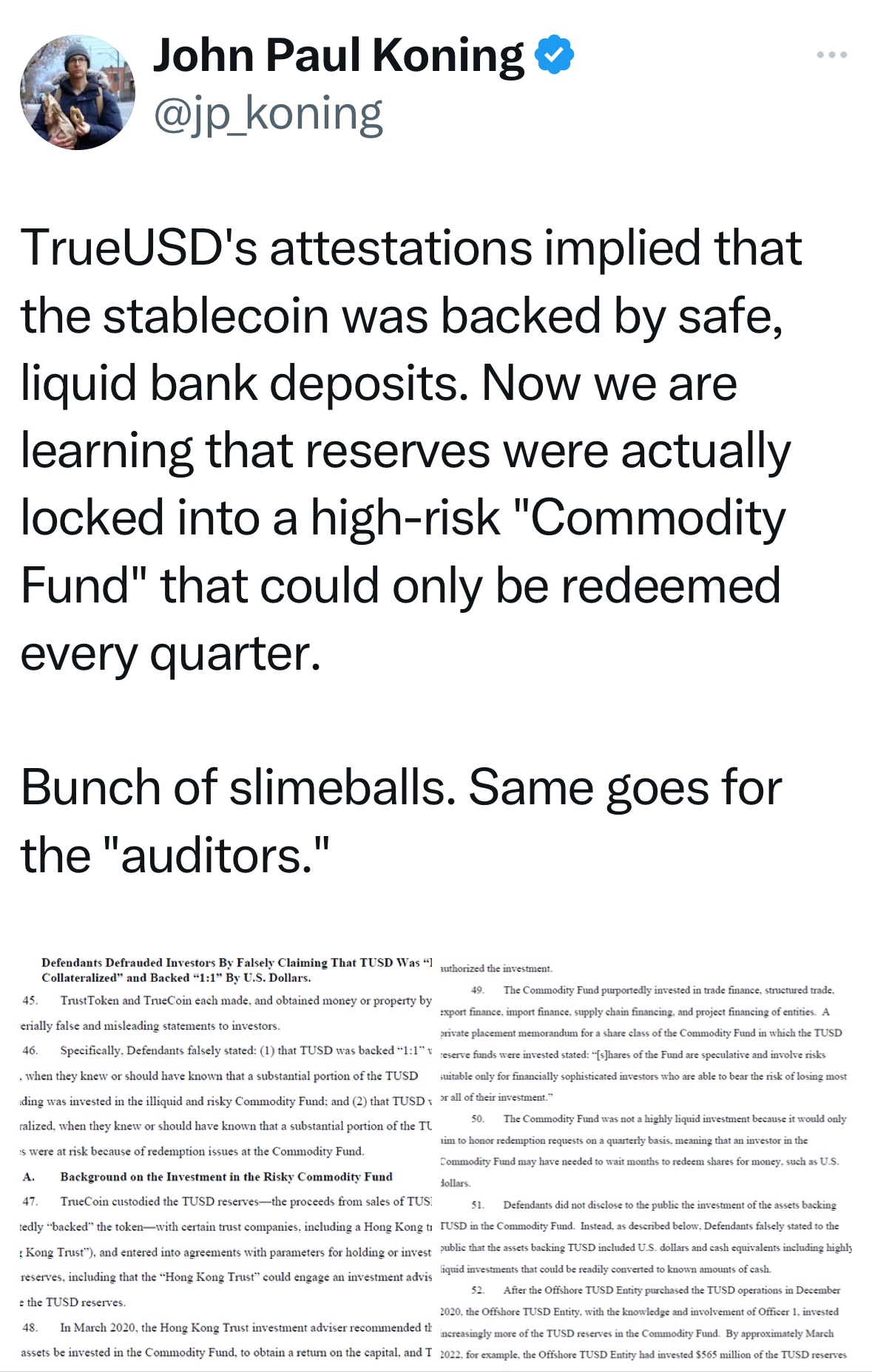

| One thing crypto aficionados like to argue is that most crypto scams are just old-fashioned scams, and digital assets just happen to be what gets plundered. This appears to be the case with TrueUSD, a stablecoin designed to have its value pegged to one US dollar and backed by reserves. Following an investigation, the US Securities and Exchange Commission alleged that TrueCoin LLC and TrustToken Inc., the companies behind TrueUSD, made false claims about the stablecoin being fully backed by US dollars or the equivalent. In reality, a significant portion of the reserves backing TrueUSD were reportedly invested in a risky offshore fund. Representatives for TrueUSD did not reply to requests for comment. "Rule number one is don't lie to your investors and users, and that appears to have been violated here," Austin Campbell, who runs a consulting firm for blockchain companies, wrote on X. It's "ironic that something named 'TrueUSD' is doing that." Assuming the SEC's allegations about TrueUSD are accurate, as Campbell suggests, this is a textbook case of a scam, not necessarily a "crypto-native" one. Yet because of the "crypto" branding, TrueUSD arguably reflects a problem unique to crypto. For those familiar with my colleague Emily Nicolle's coverage of TrueUSD, the SEC's findings may not come as a complete shock. TrueUSD has a complex and opaque ownership structure, with control shifting to an offshore entity called Techteryx Ltd. and its reserves moved to banks in the Bahamas. At the time, the company told Emily that it moved funds to the Bahamas as a result of worsening banking conditions for crypto businesses in the US. That was when the failure of Silvergate Bank, Silicon Valley Bank, and Signature Bank left many crypto firms in the lurch. Like many crypto firms in the US, TrueUSD's parent companies were rushing to find new solutions to hold their cash. Now, imagine someone with questionable credibility approaching you and asking you to deposit your dollars into an offshore entity, promising returns. Most people would immediately refuse. And even after thinking it through, most would still decline. Yet in the case of TrueUSD, many said yes: It was once the world's fifth-largest stablecoin by market value, and Binance, the largest crypto exchange by volume, promoted trading of it with zero fees. And don't forget this is at least the second time we saw a stablecoin project – one of crypto's experiments that is closest to traditional banking – fail the industry. TerraUSD, an ambitious project to create a dollar-pegged token without 100% reserves, famously collapsed in spectacular fashion and triggered widespread turmoil. Now, there is TrueUSD.

People fall for this type of hype and flawed ideas because one of the core ideas of crypto is that it's trustless, meaning there are no third parties that you need to have faith in. And because of that, the thinking goes, assets on a blockchain offer a better solution than the traditional financial industry. Unfortunately, the trustless nature of crypto has become one of its great vulnerabilities today, as many take advantage of it and turn it into a marketing scheme. And that underscores why it's important for regulators to better codify how the industry should be regulated. A good first step would be the passage of a stablecoin bill here in the US. The industry and the world don't need another stablecoin failure. |

No comments:

Post a Comment