| Good morning. Stocks keep going higher — this time in the wake of China stimulus plans. Citi and Apollo are teaming up on private credit. And cash just keeps flooding into money market funds. Here's what's moving markets. — Isabelle Lee The S&P 500 rose to close at its 42nd record high this year while the Nasdaq 100 climbed. Markets were buoyed by data highlighting a resilient US economy and a pledge by China's top leaders to support fiscal spending. US stock indexes were also propelled higher by Micron, which gave a strong forecast aided by AI demand. Meanwhile, Chinese stocks have been on a tear, with the Nasdaq Golden Dragon Index soaring 19% in the last four days. These shares should be a key part of investors' plans once the US election is over, according to Scott Rubner of Goldman Sachs. Citigroup and Apollo are teaming up in the fast-growing private credit market, agreeing to work together on $25 billion worth of deals over the next five years. The two Wall Street heavyweights have struck an exclusive partnership to arrange financings for corporate and private equity clients, according to a statement seen by Bloomberg. Mubadala Investment and Apollo's insurance unit Athene will also participate in the venture, which will initially focus on North America. The two firms have set one of the most ambitious targets to date in a string of tie-ups between banks and private credit managers that is reshaping Wall Street and capital markets. Investors are still dumping cash into US money-market funds, pushing assets under management to a fresh record despite the dawn of the Federal Reserve's interest-rate cutting cycle. Some $121 billion was added to the funds in the week ending Sept. 25, according to Investment Company Institute data released on Thursday. The inflows put total assets at a record $6.42 trillion. Such strong demand comes even as some money managers — including Jerome Schneider, head of short-term portfolio management and funding at Pacific Investment Management Co. — say it's time to pull cash out of money market funds. Vice President Kamala Harris lambasted Donald Trump for seeking to pressure Ukraine to negotiate an end to Russia's war, defending continued assistance to Kyiv ahead of an election in which the conflict has become a political flashpoint. Harris, while she did not mention Trump by name, said those "proposals are the same as those" of Russian President Vladimir Putin as she met with Ukrainian President Volodymyr Zelenskiy on Thursday. She labeled calls for Ukraine to give up territory in exchange for peace "proposals for surrender." US President Joe Biden meanwhile announced new military assistance for Ukraine and plans to convene a leader-level meeting of key allies to coordinate additional support when he visits Germany next month. "We have to strengthen Ukraine's position on the battlefield," Biden said Thursday as he welcomed Zelenskiy to the White House. Trump, meanwhile, said that he plans to meet with the Ukrainian president on Friday. China industrial production numbers will be in focus for macro traders Friday following the latest stimulus announcements from Beijing. Sri Lanka — which has just elected a new president who plans to start talks with the IMF — will have a central bank rate decision. And the big data out of the US will be the closely watched personal income and spending report, which includes the personal consumption expenditure inflation index that the Fed likes to use. Here's what caught our eye over the past 24 hours: - New York City's mayor Eric Adams was corrupt for years, US prosecutors claims in scathing case

- Bonus-starved bankers are jumping ship for private credit riches

- Wells Fargo has entered a key new phase of its effort to escape a Fed cap on its assets

- The stock market's " Goldilocks zone," is at risk of coming to an abrupt end

- Israel rejects cease-fire talks. keeps up attacks in Lebanon

- Wide-leg jeans spark $700 shopping spree to go with item

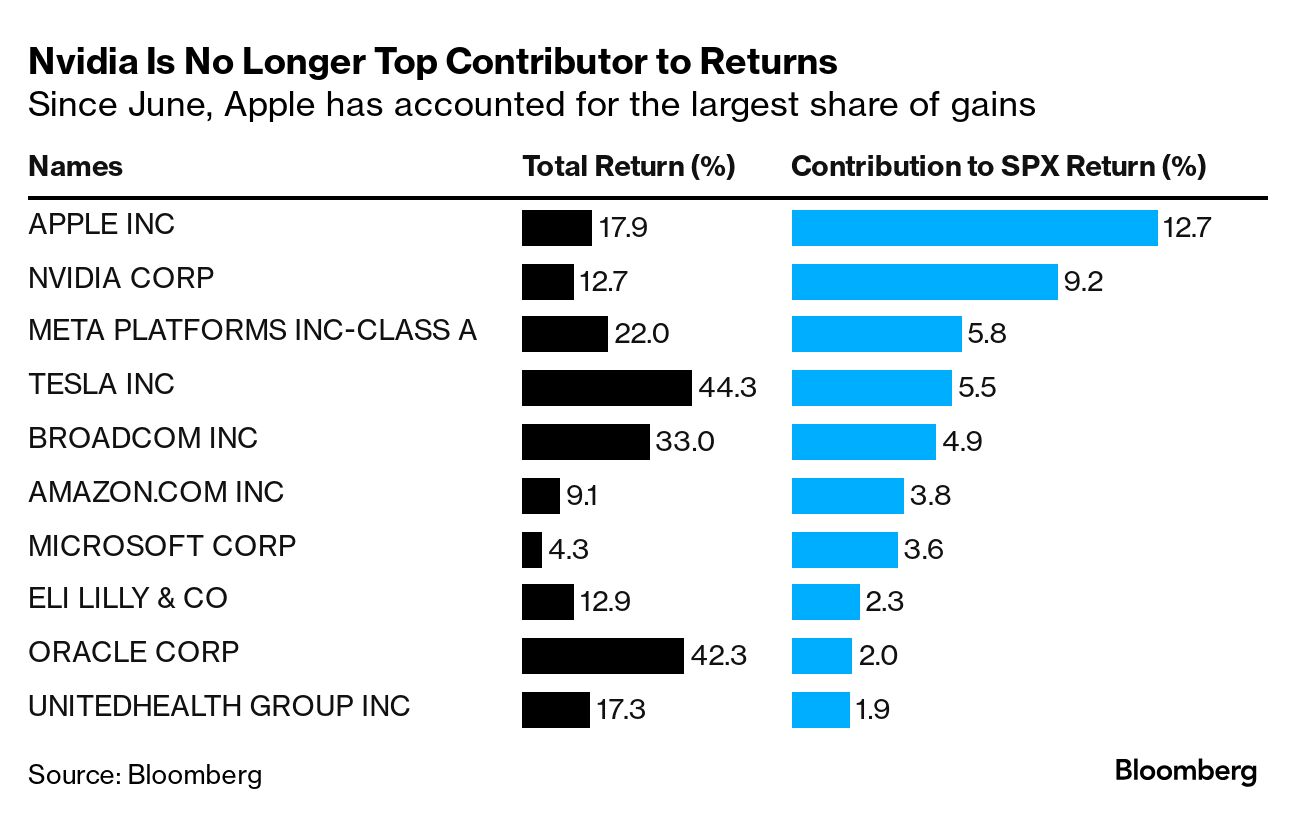

Nvidia remains the top driver of S&P 500 returns this year -- however, the market has been growing less dependent on the AI darling. Apple has trumped Nvidia as the largest contributor to S&P 500 gains in the second half of the year — a role the iPhone-maker last claimed in 2023 — accounting for nearly 13% versus Nvidia's 9% share through Wednesday's close. That's a far cry from the more than 20% the AI giant has contributed year-to-date, and the more than 30% just in the first half. Of course, on shorter time frames, the stock still has a massive impact on the benchmark's performance. Consider colleague Cameron Crise's findings that just last month, Nvidia generated some of the largest-single stock contributions to one-week S&P 500 returns in at least a quarter-century. However, monthly returns show a more balanced picture. S&P 500 monthly gains ranged from 1-2% over the past three months, and Nvidia's contribution accounted for about 5% in August and ~15% in September so far (the stock fell in July so it didn't help the SPX at all then). Now, the benchmark is still very much reliant on the Magnificent Seven as whole, accounting for a whooping 85% share of returns in September. Still, as Nvidia's earnings growth appears to have peaked in the near term at least, the stock's influence on the market might be doing so too. And breadth has indisputably improved, as evidenced by the equal-weighted S&P 500's ascent to fresh highs in recent months. Tatiana Darie writes for Bloomberg's Markets Live blog in New York. Follow her on X at @tatianadariee. |

No comments:

Post a Comment