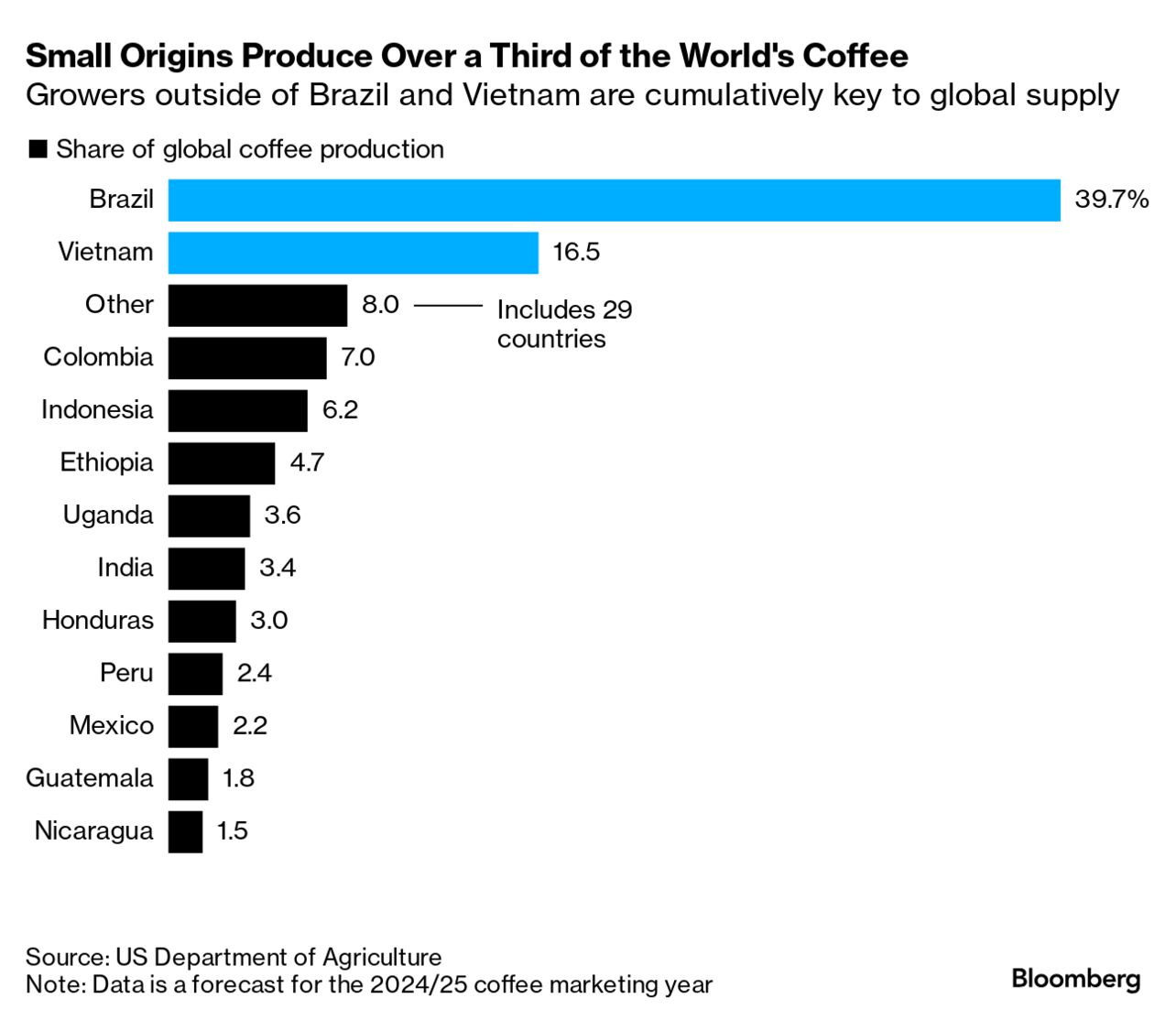

| Sipping coffee from Cuba, Rwanda and other less common origins is a delight for many caffeine lovers in search of diverse flavors and aromas. But it also matters for the industry's future. Some 40 countries grow coffee, but more than half of global production has long come from just two: Brazil and Vietnam. So when bad weather hits both — an increasing risk in a destabilized climate — supplies get threatened and prices soar. Take this year's $9 lattes, as drought gripped both nations. A similar vulnerability has also played out in chocolate this year as cocoa prices spiked to a record because of bad weather and disease in Ivory Coast and Ghana, which make up the majority of global supplies. Coffee importers and roasters realize this urgency and the need to climate-proof supplies. As Bloomberg's Ilena Peng and Tarso Veloso document in their story this week, companies are investing in diversifying their supply chains. There's more support for farmers in nations from Peru and Tanzania to Rwanda and the Democratic Republic of Congo. Still, it's unlikely that retail prices will drop any time soon. That's because smaller producers lack the economies of scale boasted by Brazil and Vietnam, often relying on family farms that harvest by hand. Production efficiencies and the lower prices they bring are what led the industry to rely so much on just two countries in the first place. Even so, consumers today are willing to pay more for top-end, small-origin coffees than they once were. Shipping Rush There's another interesting development in coffee. Traders have been racing to ship as much to Europe as they can to stock up on beans before the region's new deforestation rules kick in at the end of this year, Bloomberg's Mumbi Gitau reports. Under the legislation, importers will have to prove that commodities don't contribute to destroying forest land. Coffee — a crop that is largely reliant on millions of small growers across a wide swathe of the globe — is especially vulnerable to the challenges of ensuring every bean is in compliance. A lack of clarity on the details has also left many businesses inadequately prepared, risking supply disruptions. A new platform is slated to launch later this year that aims to provide a solution to the EU's traceability requirements. —Agnieszka de Sousa in London |

No comments:

Post a Comment