| I'm Michael Sasso, an economy reporter in Atlanta, and today we're looking at how the US election is affecting business plans. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Vice President Kamala Harris said her priority, if elected president, would be helping the middle class address economic concerns.

- China is considering allowing refinancing on $5 trillion in mortgages.

- The US workforce will grow over the next decade at the slowest pace on record.

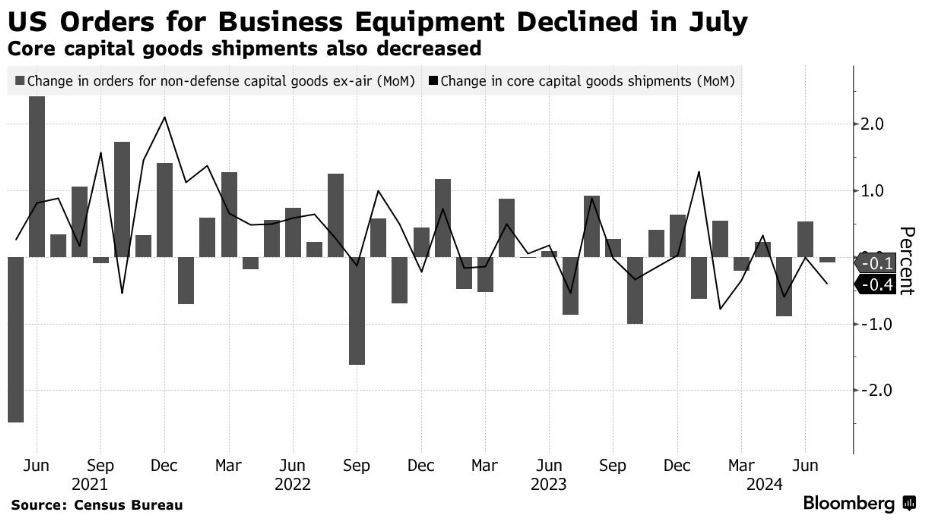

There's a time-honored tradition among US corporatechieftans of blaming a looming election for their troubles. But in 2024, things have appeared to reach a new level. Executives are bringing up elections in earnings calls "earlier and more abruptly" than in past election cycles, according to analysis by Goldman Sachs. Almost one in five earnings calls mentioned "election" in the second quarter, the Wall Street bank found. That's more than 5 percentage points higher than in the same period of 2020 and 2016, according to Goldman. Some examples: - Michigan-based Alta Equipment CEO Ryan Greenawalt cited customers of the heavy equipment retailer and servicer saying, "I'm going to keep my older piece of equipment until after the election, when I know more about tax, future tax ramifications of buying capital equipment."

- Applied Industrial Technologies of Ohio, which designs and distributes engineering products, said the demand backdrop is "choppy" thanks in part to what CEO Neil Schrimsher said was "uncertainty around the upcoming US election."

- Ryan McMonagle, CEO of Missouri-based Custom Truck, said some smaller contractors the truck and heavy-equipment firm service are "just waiting on some certainty around the election."

A recent survey of Texas manufacturers by the Federal Reserve Bank of Dallas similarly featured several colorful comments, anonymously attributed, about the election. "It's like, we all know the world will continue regardless of who wins, but we're all sitting on our hands until a winner is announced," said one machine manufacturer. The election is having an impact in other ways, too, as this newsletter noted last week, with imports surging in part thanks to preparing for the risk of higher tariffs when a new administration takes over in 2025. As for capital spending, the likelihood is some negative impact in the run-up to voting day, which is then made up for afterwards, according to Goldman economists led by Jan Hatzius. "A temporary headwind" to capital spending is what's likely, the Goldman team wrote. Firms that mentioned election uncertainty in their second-quarter earnings calls saw capital expenses growth that was slower than firms that didn't. The election worriers should start boosting their spending at an outsize clip once a winner is declared, the bank said. - India's rapid growth is set to moderate as consumers turn wary.

- The Chinese currency hit the strongest level in more than a year .

- UK house prices unexpectedly fell in August.

- Australian retail sales stagnated as elevated rates bite for consumers.

- Euro-area inflation plunged to the lowest level since mid-2021. The ECB should proceed cautiously with rate cuts, according to an Executive Board member.

- Tokyo inflation topped expectations, supporting the case for the Bank of Japan to hike.

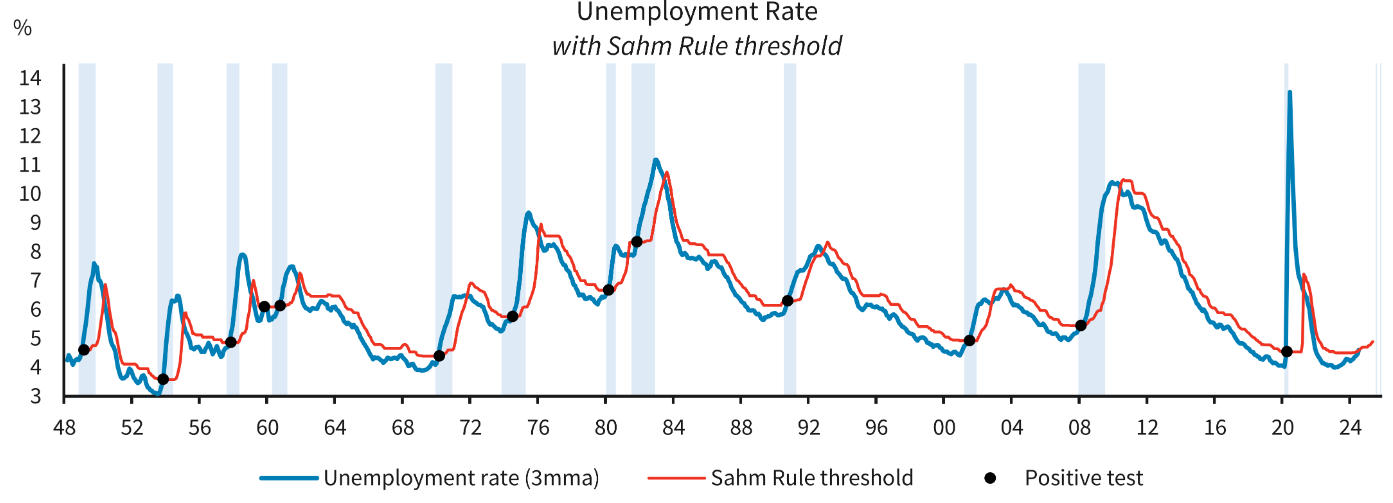

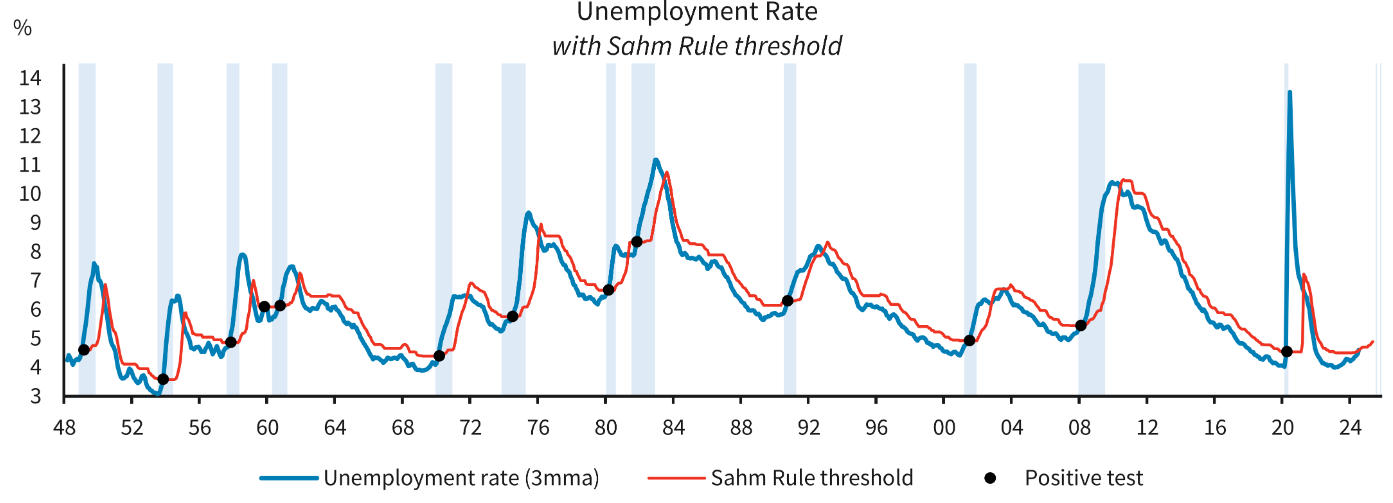

Barclays on Thursday published a "user's manual" taking a comprehensive look at the Sahm Rule and how to interpret its apparent triggering in July, when the unemployment rate rose to a level that suggested — according to the rule — a US recession is underway. Among the Barclays team's observations: Don't think of the Sahm Rule as a leading indicator of recessions. "It has a poor track record at this purpose," economists including Jonathan Miller and Marc Giannoni wrote. And don't regard it as a reliable gauge of the duration of a downturn. "In most cases, it will continue to indicate a downturn well after it has ended."  Sources: Barclays, Bureau of Labor Statistics, Haver Analytics Perhaps most importantly: "context matters." Factors that are excluded can affect reliability, "as with any fitted equation," they wrote. "The current context closely resembles prior episodes when significant increases in the unemployment rate did not culminate in a recession." |

No comments:

Post a Comment